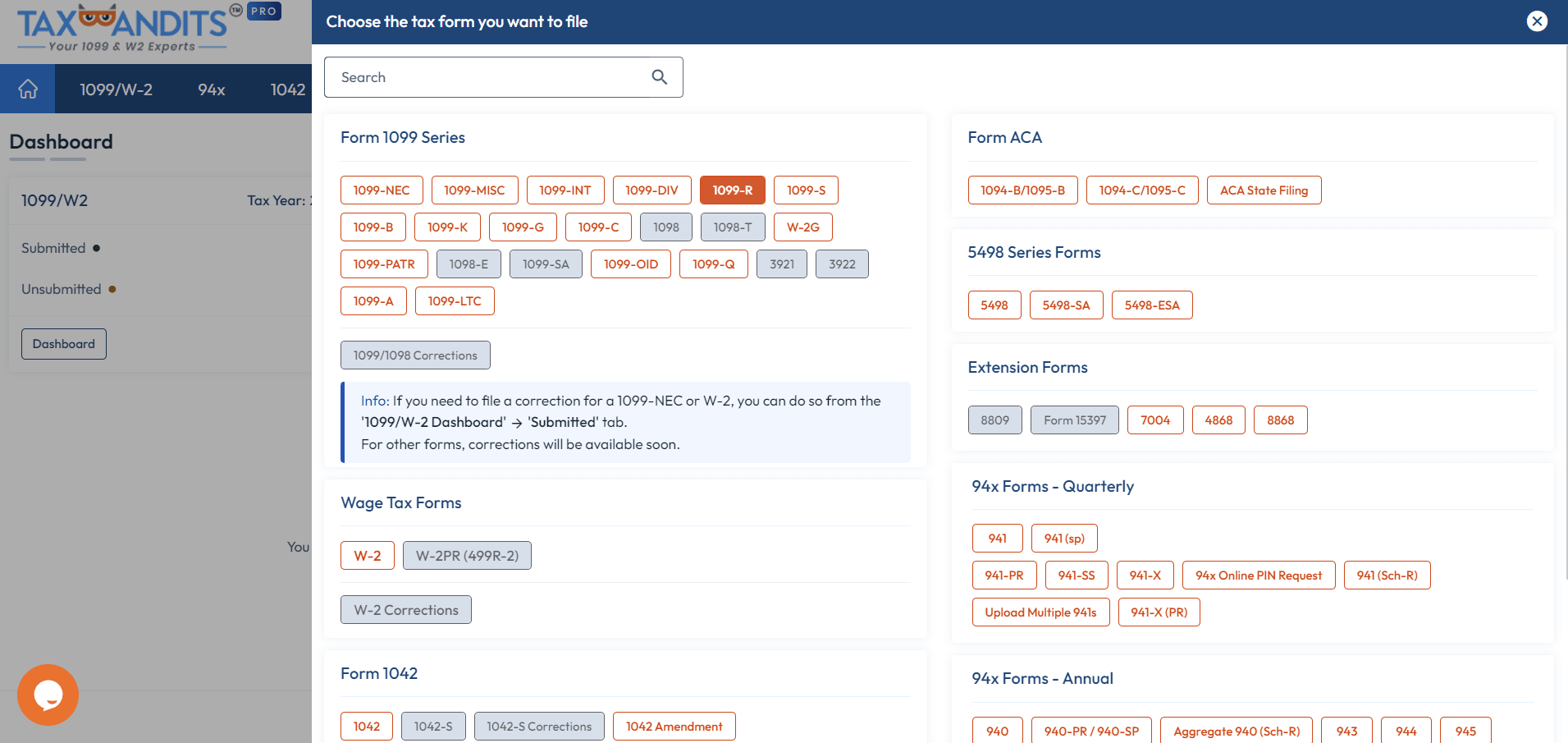

Choose the 1099 Form to E-File for 2024 Tax Year

Form 1099-R

Distributions From Pensions, Annuities, Retirement or Profit-Sharing plans.

Ready to file 1099 online?

How to E-file 1099 Form Online for the 2024 Tax Year?

Using TaxBandits’ IRS-approved 1099 filing software, you can quickly import, validate, and file your 1099 forms online with the IRS and States

Benefits of Filing 1099 Online with TaxBandits

How to E-file Form 1099 Online

PRO Features - Exclusive for Tax Professionals!

Team Management

TaxBandits offers a comprehensive solution for adding unlimited members, assigning diverse roles, controlling access levels, segmenting work, monitoring activities, and grouping members based on demographics.

Client Management

TaxBandits’ client portal, dashboard, customized email notifications, and branding options to provide your clients with a smooth and satisfying experience.This makes it easy to communicate with your clients and update them on their filing status.

Reporting

TaxBandits provides various types of reports to help you gain insights, track status, monitor performance, and optimize resources. Each report gives detailed and relevant information on your filing activities and outcomes.

TaxBandits vs. Tax1099: Why We’re the Better Choice

| Features |

TaxBandits |

Tax1099 |

Track1099 |

|||

|---|---|---|---|---|---|---|

| Federal & State Filing | ||||||

| State Recon Forms |

Free |

Additional Charges |

Additional Charges |

|||

| CD/Paper Filing |

Free |

Additional Charges |

Additional Charges |

|||

| Postal Mailing at the Lowest Cost | ||||||

| Track Delivery Status | ||||||

| Advanced Distribution Options | ||||||

| Customize Online Portal | ||||||

| Own File Data Import | ||||||

| Copy & Paste Data | ||||||

| Built-in Error Check |

Choose TaxBandits for a faster, more reliable, and IRS-compliant filing experience.

Customer Testimonials: See Why Businesses Trust TaxBandits

Trusted and loved by users like you.

4.8 rating of 12,784 reviews

See how TaxBandits facilitated various businesses to File Form 1099 efficiently!

Frequently Asked Questions about filing 1099 Form

What are the new changes on Form 1099 for 2024 tax year?

Like every year, the IRS has made several changes to Form 1099 for the 2024 tax year, affecting various types of transactions and filing requirements.

-

Form 1099-K Threshold for 2024:

- The anticipated change requires third-party network transactions (e.g., PayPal, Venmo, Cash App) to be reported on Form 1099-K if the transaction threshold remains at $5,000.

-

Form 1099-NEC and 1099-MISC Changes for 2024:

- No major changes have been made to Form 1099-NEC and 1099-MISC for the 2024 tax year. However, it is important to note that penalties for these forms have increased. Check out the recent changes in 1099 penalties for the 2024 tax year.

What is a Form 1099?

The Form 1099 series is a group of forms that the IRS refers to as “Information Returns”. These forms are used to report certain types of payments that a business makes during the year to anyone that is not a regular employee.

Some examples include compensation paid to independent contractors, interest amounts paid by the bank or any financial institution, and dividends paid in exchange for stocks or any mutual funds.

The individual or businesses that made payments to the non-employee are required to submit Forms 1099-NEC to the IRS and send a copy to the recipient.

Need a solution for e-filing Forms 1099? File your 1099 form online securely and accurately to the IRS using TaxBandits, an IRS-authorized e-file provider. File 1099 Now

What is Form 1099-NEC?

IRS Form 1099-NEC is used by individuals or businesses to report the compensation paid to non-employees (self-employed, freelance, or independent contractor) of at least $600 or more during the calendar year.

John, a small business owner, hired a graphic designer, Sarah, to create a logo and marketing materials for his new product line. As Sarah is a 1099 independent contractor, John paid her a total of $800 for her services over the course of the year. To ensure compliance with IRS regulations, John needs to file Form 1099-NEC to report the compensation paid to Sarah.

What is Form 1099-MISC?

Form 1099-MISC is used to report certain types of Miscellaneous payments made to non-employees for the services offered during the calendar year.

Form 1099 MISC reports the payment made to someone of at least $600 or more, this includes rental payments, prizes, and rewards, payments made to an attorney, Crop insurance proceeds, and fishing boat proceeds.

The following also applies to reporting payments on Form 1099-MISC:

- At least $10 is made from royalty or broker payments in lieu of dividends.

- Direct sale of $5,000 of any consumer product, etc.

- The federal income tax is withheld under the backup withholding rule, even if it is less than $600.

Nick owns a two-story apartment building and rents out one of the units to Sarah for $400 per month. As Sarah pays her rent in cash, she is required to report this rental payment on Form 1099-MISC and send it to Nick as the landlord. This ensures that Nick properly reports the rental income on his tax return, as required by the IRS.

What is Form 1099-K?

Form 1099-K is an IRS tax return used by the payment settlement entities to report any commercial payment made to individual or business entities through payment cards (Credit/ Debit card ) or third-party network transactions (PayPal, Venmo, etc.) of at least $5000 with over 200 transactions made during the calendar year.

Sarah operates a small business selling handmade jewelry on various online platforms. Over the course of the year, her total sales through PayPal transactions amounted to $5000. As this amount exceeds the threshold for Form 1099-K reporting, Sarah's payment settlement entity (PayPal) must file Form 1099-K to report the commercial payments made to her for the sales of her handcrafted items.

What are other 1099 Forms available?

There are over twenty different types of Form 1099 available, which include Form 1099-INT, Form 1099-DIV, Form 1099-K, etc. Each 1099 tax form is used to report different types of income or transactions made to taxpayers during which include Form 1099-INT, Form 1099-DIV, Form 1099-R, etc. year. Here are some of the most common types of 1099 forms used by payers to report payment information to the IRS.

Form 1099 INT - To Report Interest Income

Form 1099-INT is used to report interest income. The payer of the interest income must file Form 1099-INT if they have paid at least $10 or more as interest. Form 1099-INT must also be filed if any withholding is made under the backup withholding rules. Usually, banks, brokerage firms, or any financial institutions use Form 1099-INT to report the interest amounts paid to their recipients.

Form 1099 DIV - To Report Dividends and Distributions

Form 1099-DIV is used to report dividends and distributions paid to individuals for the investments they made. Form 1099 DIV is most often used by banks and financial institutions.

Other 1099 Forms

-

Form 1099 R

Form 1099-R is used to report any distribution of $10 or more from profit-sharing, retirement plans, IRAs, pensions, annuities, retirement, insurance contracts, etc.

-

Form 1099 S

Form 1099-S is used to report the proceeds from real estate transactions and to report the sales or exchange of real estate.

-

Form 1099 B

Form 1099-B is used to report the proceeds from the broker and barter exchange transactions. It should be filed for each person to whom the stocks or commodities were sold for cash. It is also used to report stock acquisition of control or change in the capital structure.

-

Form 1099 C

Financial entities that forgave an individual debt of $600 or more during the tax year must file Form 1099-C with the IRS and distribute copies to this recipient.

-

Form 1099 G

Federal, state, and local governments that make payments to individuals, including unemployment compensation, income tax credits, refunds or offsets, RTAA payments, taxable grants, and agricultural payments, must file Form 1099-G .

-

Form 1099-PATR

Cooperatives are required to file Form 1099-PATR if they paid at least $10 in patronage dividends and any distributions described under section 6044(b). They must also report any federal income taxes under the backup withholding rules on Form 1099-PATR.

When is Form 1099 due for the 2024 Tax Year?

Unlike other tax forms, Most of the 1099 Forms have the same deadline, which is

- Recipient copies of the Form 1099 for 2024 tax year should be distributed to the recipient on or before

January 31, 2025. - Paper copies of Form 1099 for 2024 tax year should be filed with the IRS on or before February 28, 2025.

- E-filing copies of Form 1099 for 2024 tax year should be filed with the IRS on or before March 31, 2025.

However, there are some exceptions to this deadline

- The deadline for filing Form 1099-NEC for both recipient copies and IRS falls on January 31st, regardless of the filing methods.

- If you are reporting payments in box 8 or 10 of Form 1099-MISC, then the deadline to report recipient copies on February 17.

- The deadline to report the recipient copies of 2024 Form 1099-S and 1099-B is February 17, 2025.

Find your 1099 form due date for 2025 here.

Does Form 1099 need to be filed with the state?

Some states have mandated the 1099 filing to report state withholding. The state filing requirements for Form 1099 depend on your state, and they vary for each state. Your 1099 filing is not complete until you have met your

state requirements.

How do I correct Form 1099?

If you have identified any errors on your previously filed Form 1099, you have to correct them, submit a correction form to the IRS, and send the same to the recipient.

Form 1099 correction can be done for two different types of errors Type 1 and Type 2:

- Type 1 errors include reporting the incorrect payment amount, using codes, or not filing for the right recipient.

- Type 2 errors include a missing or incorrect payee TIN or name, or filing the return using the wrong type

of return.

Want to file a correction Form? Get Started Now with Taxbandits and file your 1099 Correction Form to the IRS securely. With TaxBandits you can also send the corrected copies to your recipient. E-File 1099 Now

How to Correct Payer Information on Submitted Form 1099?

In order to correct the payer information on Form 1099, you must send a written statement to IRS providing the

following information:

- Payer name

- Payer Address

- Type of error(include the incorrect payer name/TIN that was reported)

- Correct payer TIN

- Tax year

- Number of payees

- If federal income tax was withheld

TaxBandits supports 1099 corrections, these are the steps to get started.

- Step 1: Create a Tax Bandits account.

- Step 2: Choose “payer information” under the 1099 correction.

- Step 3: Download the written statement.

- Step 4: Sign and mail it to the IRS.

The statement must be sent to the following mailing address.

Internal Revenue Service,

230 Murall Drive,

Kearneysville, WV 25430.

How to get an extension of time to file Form 1099?

If you need more time to complete and file 1099 online forms, you will need to request an extension using Form 8809. If the IRS accepts your request, you will have an additional 30 days to file 1099s with the IRS. This extension does not apply to Form 1099-NEC for reporting non-employee compensation.

Get Started with TaxBandits and get a 30 days automatic extension on your Form 1099.

File 1099 Extension Now

What is the Penalty for not filing Form 1099 on time?

Failure to file Form 1099 before the deadline or providing incorrect information can lead to IRS penalties. Penalties vary from $60 to $ 330 depending on when Form 1099 is filed with the IRS.

$60 per form- if Form 1099 is not filed within 30 days of the due date.

$130 per form - if Form 1099 is filed 30 days after the deadline but filed before August 1.

$330 per form- if Form 1099 is filed after August 1.

The IRS may also impose a penalty for the following reasons:

- Reporting incorrect information

- Not sending a copy to the recipient

- Filing by paper when required to file electronically

providing incorrect information can lead to IRS penalties.

Avoid penalties and file your Form 1099 on-time with TaxBandits. Get Started Now

What is a Form 1096?

Form 1096, also called the Annual Summary and Transmittal of U.S. Information Returns, is a summary of Form 1099. Form 1096 is used to summarize the number of 1099 forms filed with the IRS. Form 1096 is only required when the 1099 Forms are filed on paper, it is not required when filing electronically.

Get Started with TaxBandits and fIle your Form 1099 electronically with the IRS.

Helpful Resources for IRS Form 1099

What is Form 1099 NEC?

What is Form 1099 MISC?

Form 1099-NEC vs. 1099-MISC