Request Form W-9 Online Easily with TaxBandits to Streamline Your Process!

Why Choose TaxBandits to Request Form W-9 Online for 2024?

Easy and Secure Process

TaxBandits offers a comprehensive W-9 Manager solution that enables you to request W-9 Forms easily, accurately, and securely.

TIN Matching

Filing 1099 returns with incorrect TINs can lead to hefty penalties. TaxBandits helps you avoid this by performing TIN Matching on W-9s obtained.

Bulk Upload Using Excel

or CSV

Use our bulk upload templates to simplify the process and import your vendor's data. Click here to download templates.

Real-time Notifications

Once your vendors complete and e-sign their electronic W-9 forms, TaxBandits will notify you instantly

via email.

Advanced Security

TaxBandits incorporates advanced security measures to protect the PII information obtained through W-9s, such as SSN, email, etc.

Workflow Management

With TaxBandits, you can streamline your workflow, managing W-9s from multiple businesses/vendors efficiently in one platform.

Save and Continue at

Your Convenience

TaxBandits allows you to save the progress of your W-9 process at any time and continue from where you left off. It's flexible and designed to fit into your schedule.

Streamlined 1099 Filings

Use the W-9 data obtained from the vendors, generate 1099s for them at the click of a button, and e-file to the IRS on time.

Automate W-9 With TaxBandits API Integration

By integrating our developer-friendly API with your software or portal, you can enable W-9 Automation and streamlining the 1099 filings.

Frequently Asked Questions about Form W-9

What is Form W-9?

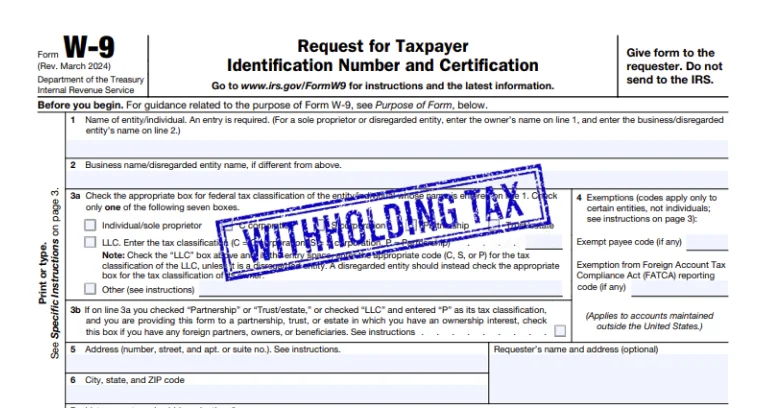

Form W-9 Request for Taxpayer Identification Number and Certification is an IRS form used by businesses to obtain Name, Address, and Taxpayer Identification Number (TIN) from contractors or vendors.

The information obtained through W-9 forms will be used to e-file the applicable 1099 forms for reporting payments made to the respective vendors.

Check out https://www.taxbandits.com/what-is-form-w9/ to learn more about

Form W-9.

What are the new updates in the Form W9 for 2024?

The IRS released the new version of Form W-9, introducing a new Line 3b, The original Line 3 has now been split into separate sections as Line 3a and 3b, respectively.

Line 3a requires business entities to indicate their federal tax classification, while Line 3b needs to be checked if the business has foreign partners, owners, or beneficiaries, which applies to flow-through entities.

Line 3b indicates if a flow-through entity has any direct or indirect foreign partners, owners, or beneficiaries when providing their W-9 to another flow-through entity. Flow-through entities are businesses where income directly flows to shareholders, who report their individual share of income on their personal tax returns instead of the total income in the business.

What information will the vendors provide on their Form W-9 Online?

Here are the details that the vendors will provide on their W-9 Forms:

- Name, Business, Federal Tax Classification

- Taxpayer Identification Number (TIN) - Eg: SSN, EIN

- Subjection to Backup Withholding

- Exemption codes for FATCA Reporting, if any

When should you request a W-9, Request for Taxpayer Identification Number, and Certification, online for 2024?

If you are a business that is required to make payments (generally, more than $600) to any individual or entities regarding any services rendered, such as independent contractors, freelancers, or consultants, you must request a Taxpayer Identification Number, and Certification from the respective payees.

By obtaining a fillable W-9 form, you can ensure that you have the necessary information to accurately file 1099 forms with the IRS at the end of the year.

How to Complete Form W-9 Online with TaxBandits?

Follow these simple steps to request Form W-9 online from your vendor:

- Step 1: Add vendor details either manually or import from QuickBooks, Xero, Zoho Books & FreshBooks

- Step 2: Request the vendor via email to complete Form W-9 Online

- Step 3: The vendor will complete and e-sign their W-9, and you’ll be notified

- Step 4: TaxBandits will validate the TINs obtained through W-9s

- Step 5: E-file 1099 forms for your vendors using the W-9 information and distribute copies

What is backup withholding?

The payments you make to the vendors will be subject to a backup withholding of 24% ifThe payments you make to the vendors will be subject to a backup withholding of 24% if,

- The vendor fails to furnish TIN

- The vendor fails to certify the TIN

- The IRS indicates that the vendor has furnished an incorrect TIN

- The IRS informs that the vendor is subject to backup withholding since they didn’t report all the interest and dividends on their tax return

- The vendor fails to certify that they aren’t subjected to backup withholding under the above 4 conditions

What type of payments are subject to backup withholding?

Here are the payment types that are subject to backup withholding

- Interest

- Tax-exempt interest

- Dividends

- Broker and barter exchange transactions

- Rents

- Royalties

- Nonemployee pay

- Payments made in settlement of payment card

- Third-party network transactions

- Certain payments from fishing boat operators

What are the penalties if the vendors fail to furnish the

correct TIN?

-

TIN Mismatch: A penalty of $50 will be imposed on contractors or vendors if they fail to provide furnish the correct TIN unless an acceptable

reason is stated. - Civil Penalty: If a vendor provides false information with respect to withholding, they will be subject to a $500 penalty.

For more details, visit irs.gov.

Success Starts with TaxBandits!

Helpful resources about Form W-9