Oklahoma 1099 Filing

Requirements 2024

The state of Oklahoma requires certain businesses to file 1099

with TaxBandits.

Lowest Pricing in the Industry - E-file at just $0.70/form

Simplify Your Oklahoma 1099 Filing

with TaxBandits

- E-file your Oklahoma 1099 in minutes

- Supports Oklahoma 1099 Corrections - Easily correct, print, and mail to the state

- Retransmit rejected Oklahoma 1099 returns at no extra cost

-

Default State

- Filing Criteria

- Information Required

- How to File

- FAQs

Oklahoma 1099 Filing Criteria for 2024

The State of Oklahoma mandates 1099 filing based on the amount of state taxes withheld and the total payments you made.

| Oklahoma State Required 1099 Forms | Form 1099 NEC |

Other 1099 Forms

(Form 1099-MISC, INT, DIV, R, B, G, OID, K) |

|---|---|---|

|

Criteria 1 If there is Oklahoma state tax withheld |

Payment Threshold: More than $0 Filing Method: Direct State Filing Additional Form: Not Required Deadline: January 31, 2025 Pricing: 1099 State filing- $0.70/form |

Payment Threshold: More than $0 Filing Method: CF/SF program Additional Form: Not Required Deadline: March 31, 2025 Pricing: 1099 State filing - Free |

|

Criteria 2 If there is no Oklahoma state tax withheld |

Payment Threshold: $750 or More Filing Method: Direct State Filing Additional Form: Not Required Deadline: January 31, 2025 Pricing: 1099 State filing- $0.70/form |

Payment Threshold: Follows Federal Threshold Filing Method: CF/SF program Additional Form: Not Required Deadline: March 31, 2025 Pricing: 1099 State filing - Free |

Ready to start 1099 E-filing with Oklahoma?

Information Required to File 1099 Forms with Oklahoma

Discover the key information needed to file Form 1099 with the State of Oklahoma.

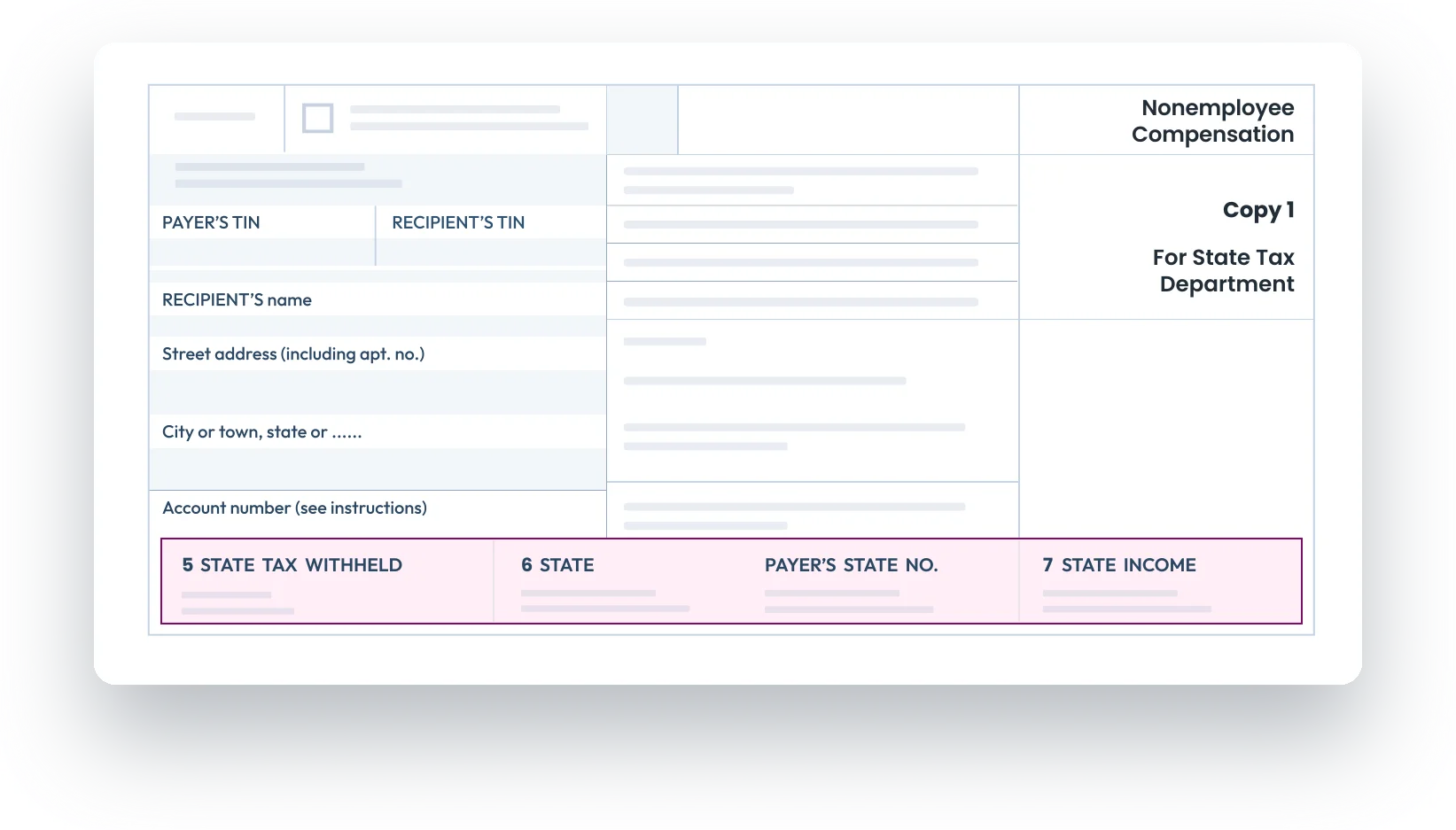

1. State/Payer’s state number

The payer's state identification number refers to the Oklahoma Withholding Tax Account Number.

Oklahoma State ID Format: 3 characters and hyphen followed by 8 digits and hyphen followed by 2 digits (Eg: WTH-99999999-99)

The state also accepts Federal TIN as the state ID number. (Eg: 999999999)

2. Oklahoma state income

The total amount of taxable income that is subject to Oklahoma state income tax.

3. Oklahoma state tax withheld

The total amount of state income taxes withheld from the recipient's income.

E-file with Oklahoma State in minutes using TaxBandits!

TaxBandits – Simplifying Oklahoma State 1099 Compliance

TaxBandits supports the e-filing of 1099 forms directly with the Oklahoma Department of Revenue, ensuring compliance with state regulations.

Lowest Pricing

Lowest Pricing

TaxBandits offers the most affordable solution for Oklahoma 1099 filings, saving you both time and money.

State Form PDFs

State Form PDFs

Easily access and download Oklahoma 1099 form PDFs for filing corrections or record-keeping purposes.

State Filing Guidance

State Filing Guidance

TaxBandits provides step-by-step instructions to complete the e-filing process from start to end without any hurdles.

Free Resubmissions

Free Resubmissions

If the Oklahoma Department of Revenue rejects your 1099 forms, you can correct errors and resubmit them for free.

Start filing your Oklahoma 1099 returns with TaxBandits by creating an account!

How do you file a 1099 Form with Oklahoma using TaxBandits?

Create your free account and follow these simple steps to effortlessly e-file your 1099 with the federal and the state of Oklahoma!

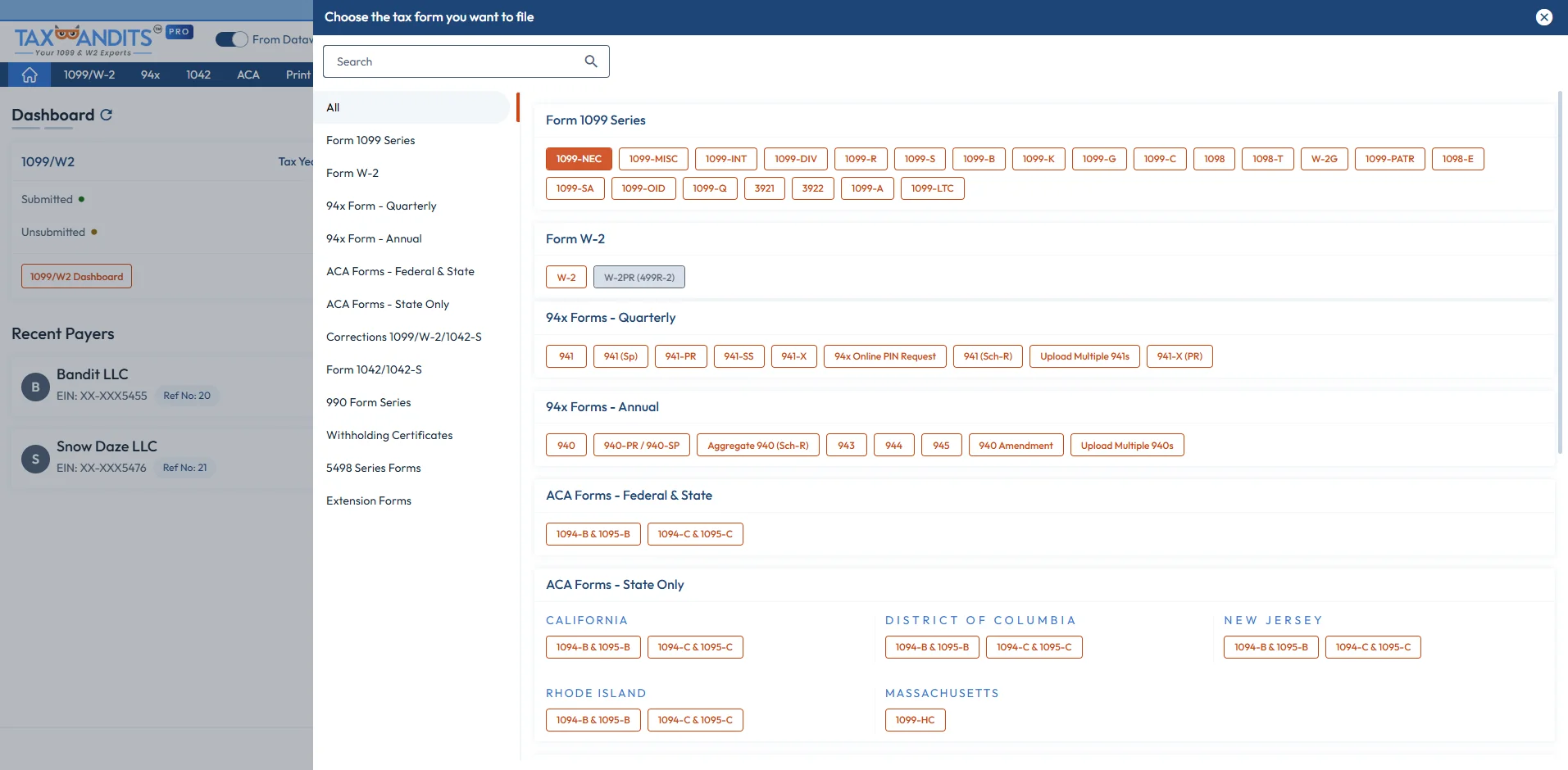

-

Step 1: Choose Form 1099

Select the type of 1099 form you want to file.

-

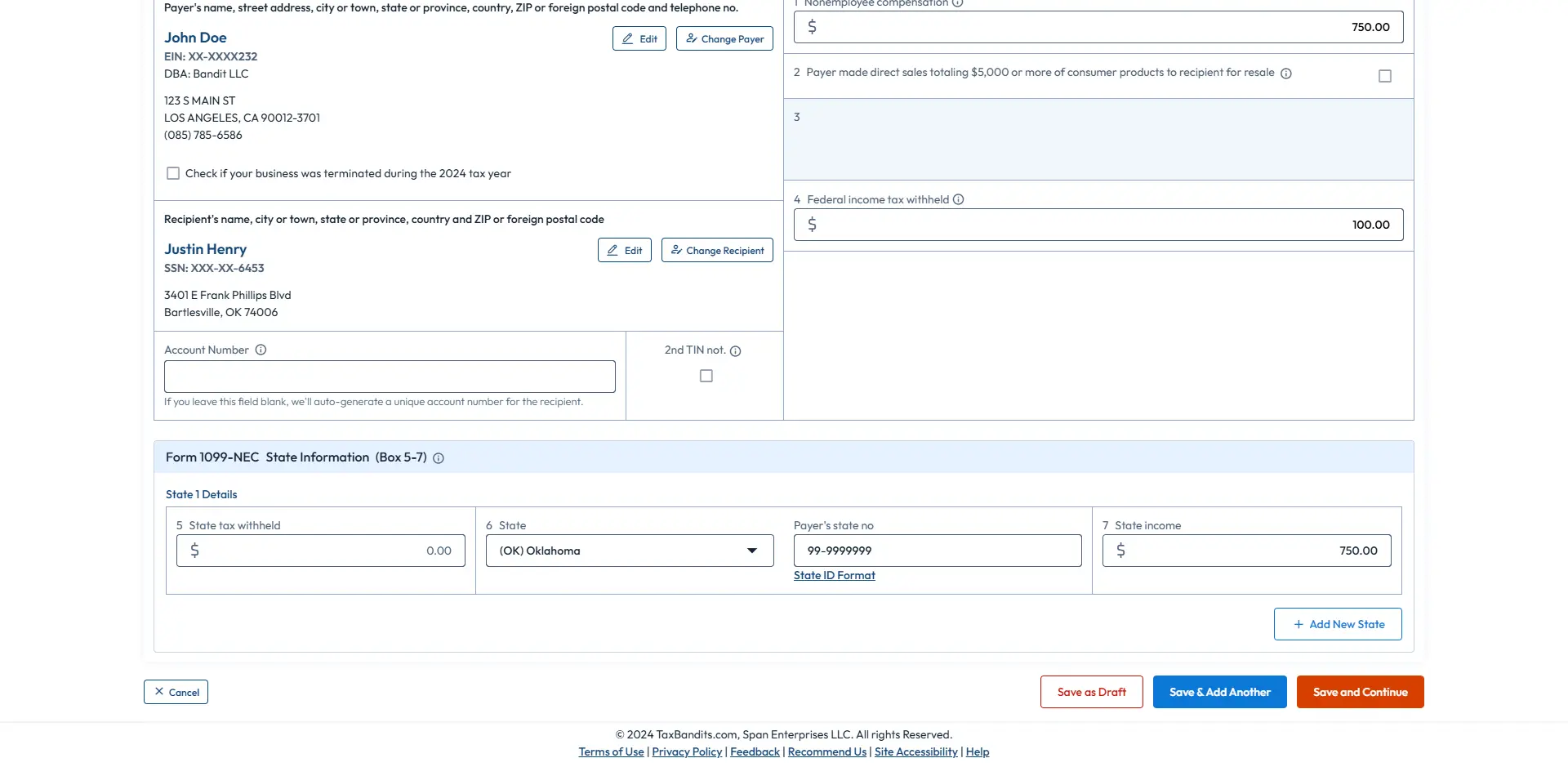

Step 2: Enter Form 1099 details

Complete the form using manual entry or other bulk import options.

-

Step 3: Enter State Filing Information

Provide the required Oklahoma state details for Form 1099.

-

Step 4: Choose Distribution Options

Opt for our distribution services – Postal Mailing, Online Access, or BanditComplete.

-

Step 5: Review and Transmit

Review your form and transmit it to the IRS and state agencies.

Are you ready to begin e-filing your 1099 Form with Oklahoma State? File in minutes with TaxBandits!

Frequently Asked Questions

Does Oklahoma require 1099 filing?

Yes, the state of Oklahoma mandates the filing of 1099 Forms:

- If a payment income of $750 or more is made to the residence of Oklahoma or any state tax is withheld during the year.

- If the source of the transaction is from Oklahoma.

What types of 1099 forms does Oklahoma require?

Oklahoma requires the filing of the following 1099 forms:

Does Oklahoma require additional forms when filing 1099 forms?

No. The state of Oklahoma doesn’t require any additional forms to file along with Form 1099. Form 1099

When is Oklahoma 1099 due?

Here are the due dates to file 1099 with Oklahoma for the 2024 tax year:

- Form 1099-NEC is due by January 31, 2025.

- Other 1099 Forms are due by March 31, 2025.

If the due date falls on a weekend or federal holiday, the next business day is the deadline.

What are the requirements to file a 1099 electronically with Oklahoma?

Oklahoma mandates 1099 Forms to be filed electronically; paper filings are not accepted by the state.

What are the penalties for not filing 1099s with Oklahoma?

- The penalty rate computes a 5% penalty on the income tax due.

- Delinquent interest, at the rate of 1.25% per month, may be charged if 100% of your tax liability is not paid by the original due date of the return.

For more information, please visit the State website: https://oklahoma.gov/tax.html

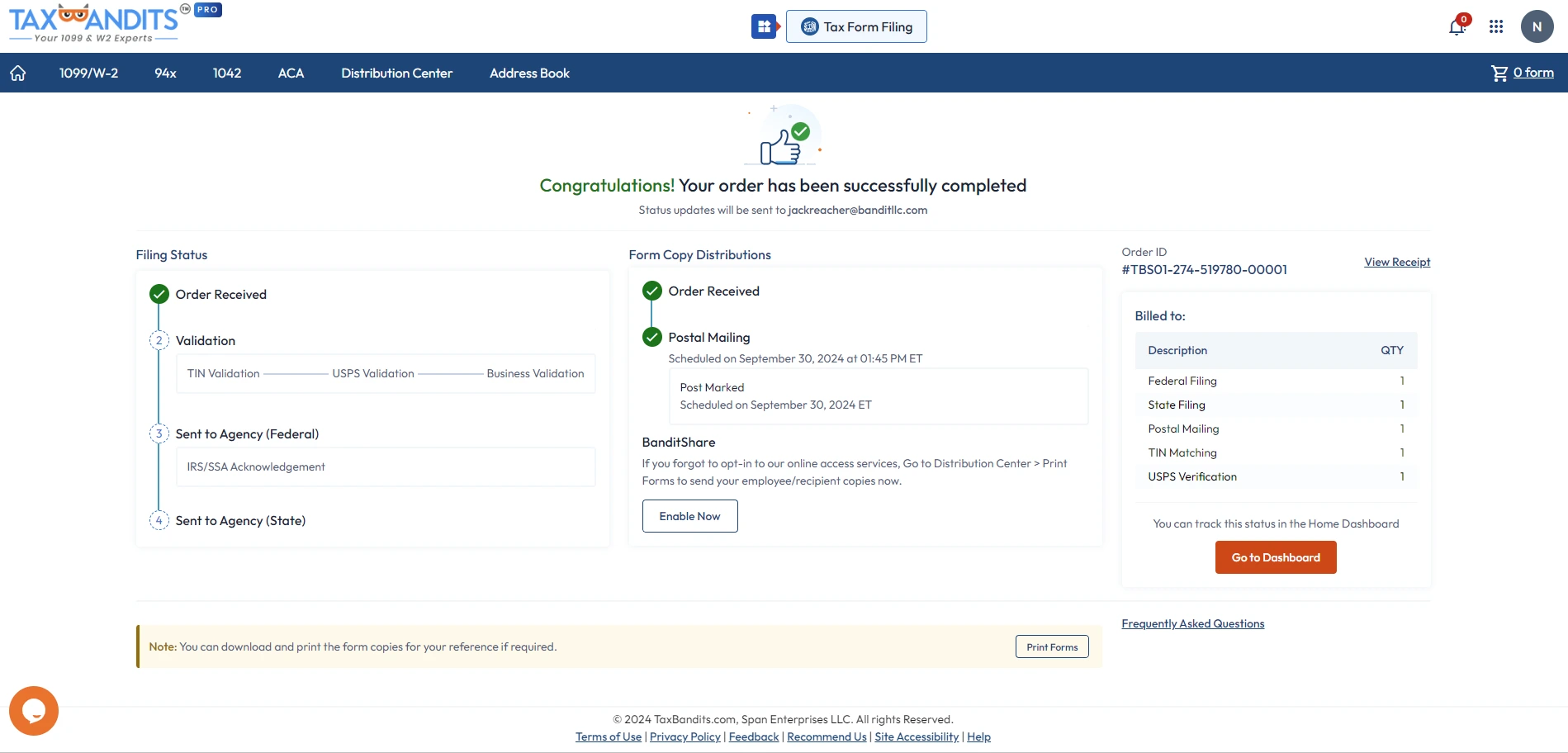

Success Starts with TaxBandits

The Smart Business Owners Choice

How to File 1099 Forms with TaxBandits

Select Form 1099

Start by selecting Form 1099 from your dashboard. With TaxBandits, you can file this form for both the current and previous tax years.

Required information

Fill out the required 1099 information and the respective state information in the appropriate fields.

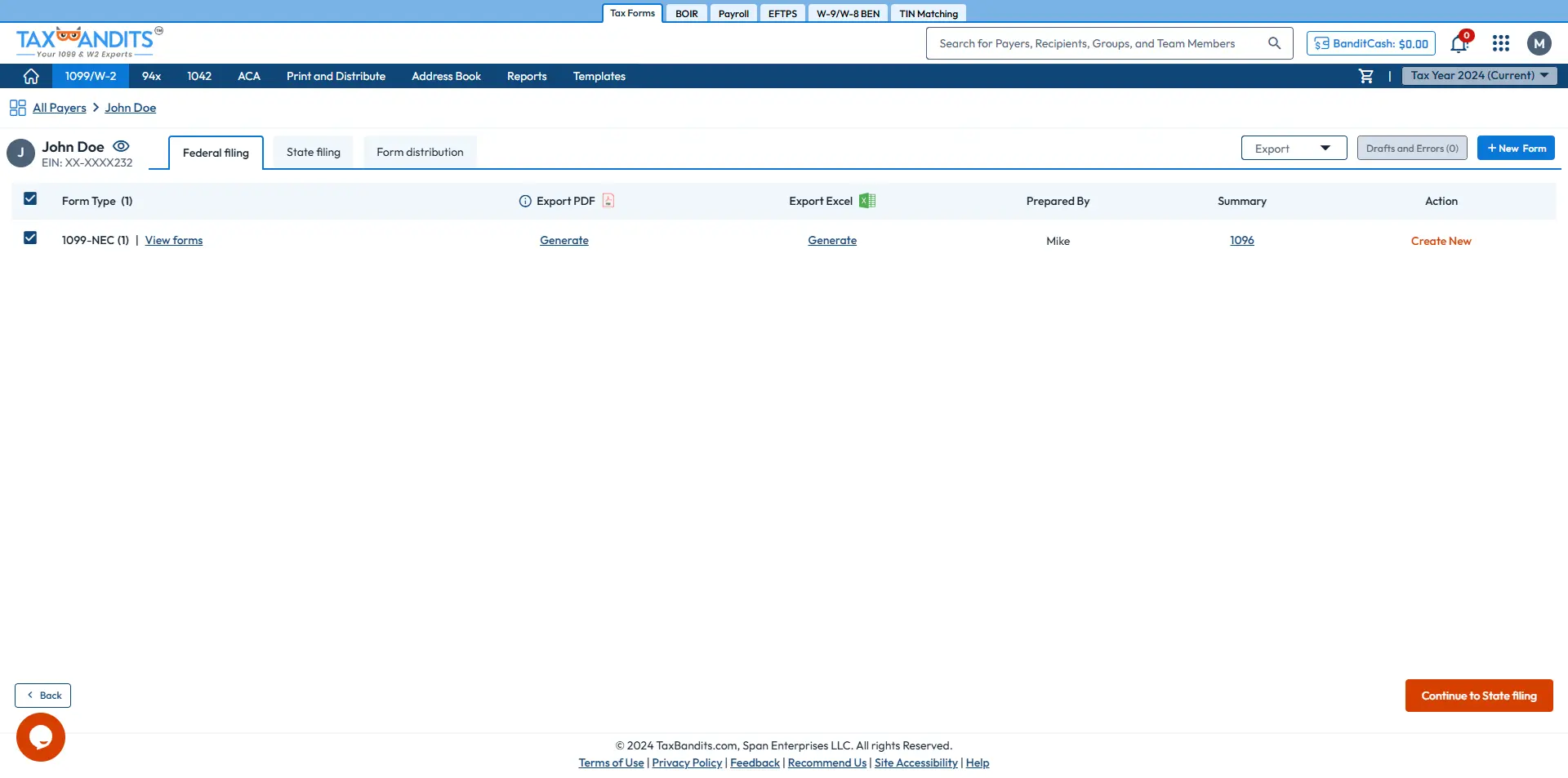

Review Federal Information

Review your Federal filing information and click "Continue to State Filing" to proceed further.

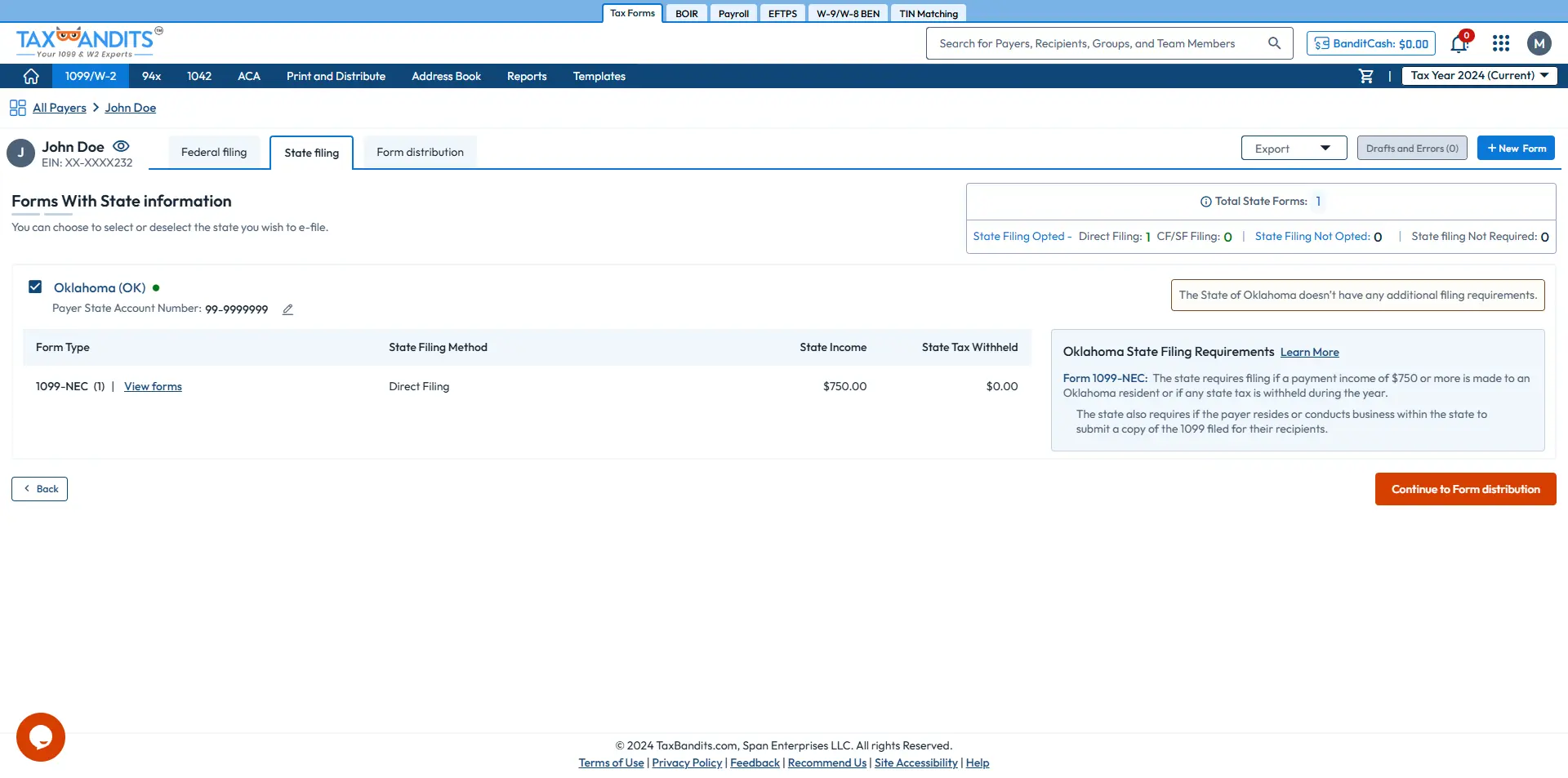

Review State Filing Information

Review your state filing information and click "Continue to form disturibution" to proceed further.

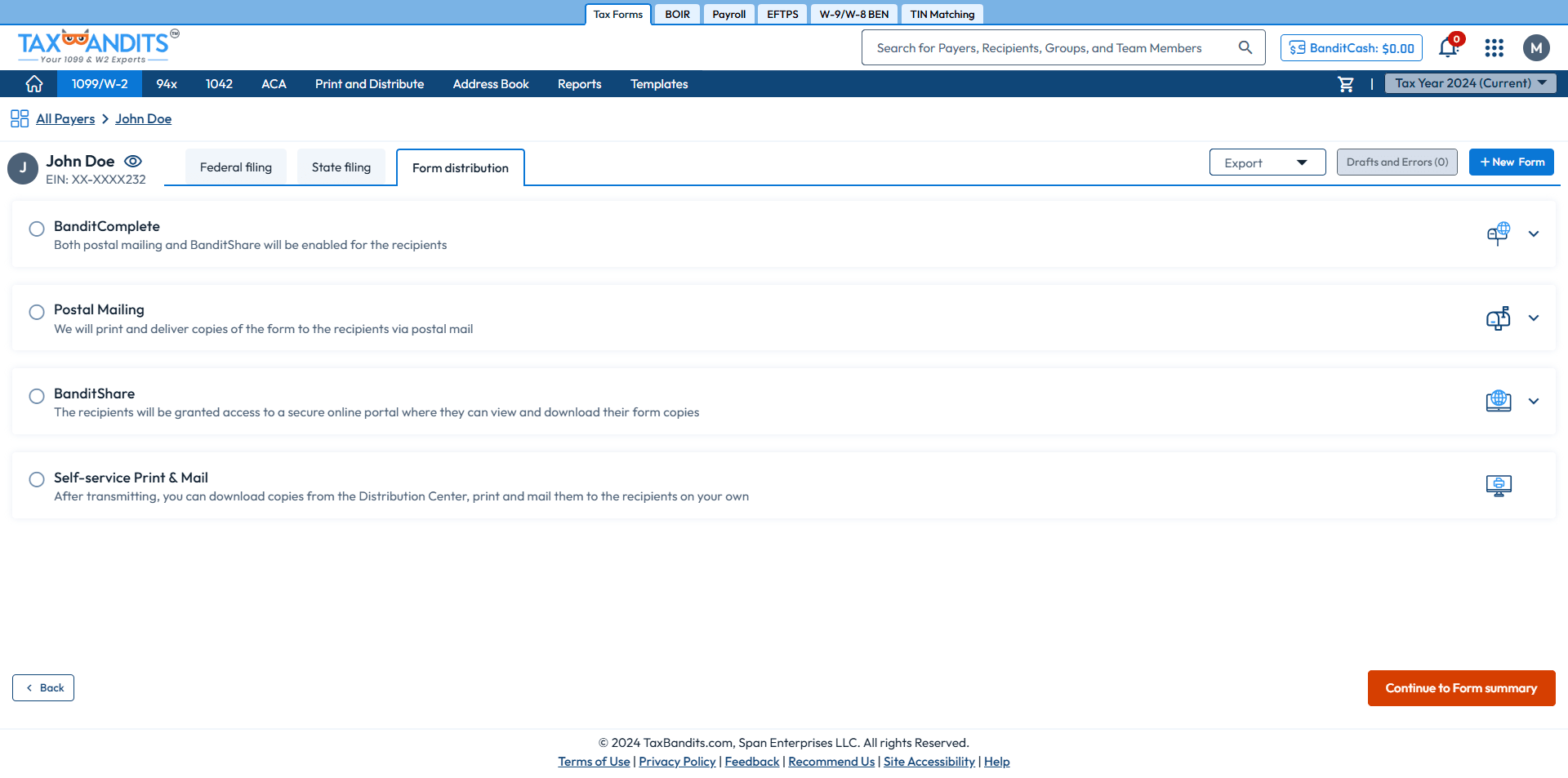

Choose Distribution Options

Select how you'd like to distribute recipient copies: via mail, online access, or with the BanditComplete option.

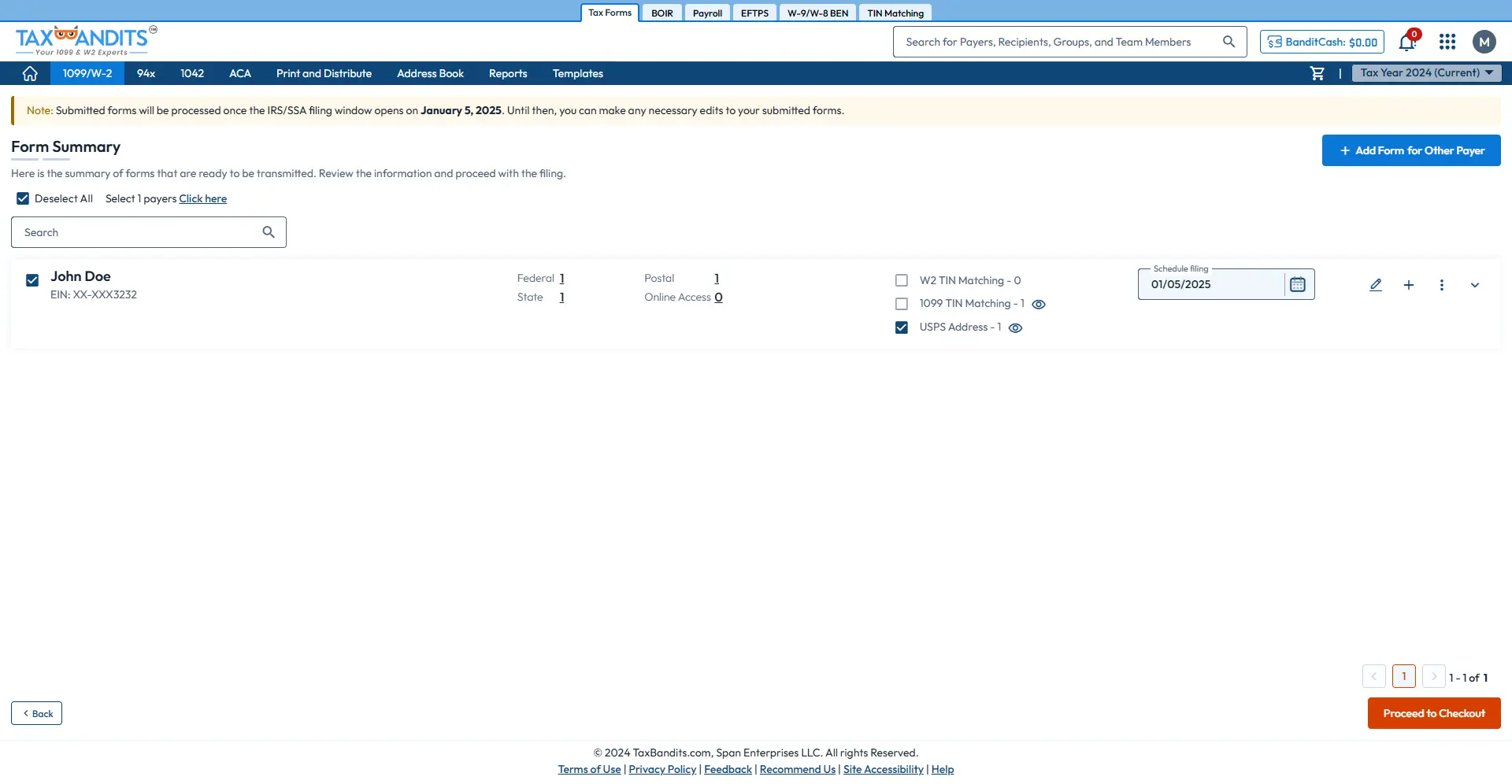

Review Form 1099 Information

Review the information and make any necessary changes if needed.

Transmit the Form to the IRS/State

After reviewing, transmit the completed Form 1099 to the IRS and state.