Vermont 1099 Filing

Requirements 2024

Meet your Vermont 1099 filing requirements efficiently with TaxBandits!

Lowest Pricing in the Industry - E-file at just $0.70/form

Simplify Your Vermont 1099 Filing

with TaxBandits

- E-file your Vermont 1099 in minutes

- Supports Vermont 1099 Corrections - Easily correct, print, and mail to the state

-

Retransmit rejected Vermont 1099 returns at

no extra cost

-

Default State

- Filing Criteria

- Information Required

- How to File

- FAQs

Vermont 1099 Filing Criteria

The State of Vermont mandates 1099 filing based on the amount of state taxes withheld and the total payments you made.

| Vermont State Required 1099 Forms | Form 1099 NEC |

Other 1099 Forms

(Form 1099-MISC, K, INT, DIV, R, B, G OID) |

|---|---|---|

|

Criteria 1 If there is Vermont state tax withheld |

Payment Threshold: More than $0 Filing Method: Direct State Filing Additional Form: Form WHT-434 Deadline: January 31, 2025 Pricing: 1099 State filing - $0.70/form |

Payment Threshold: More than $0 Filing Method: Direct State Filing Additional Form: Form WHT-434 Deadline: January 31, 2025 Pricing: 1099 State filing - $0.70/form |

|

Criteria 2 If there is no Vermont state tax withheld |

Payment Threshold: Follows Federal Threshold Filing Method: Direct State Filing Additional Form: Not Required Deadline: January 31, 2025 Pricing: 1099 State filing - $0.70/form |

Payment Threshold: Follows Federal Threshold Filing Method: Direct State Filing Additional Form: Not Required Deadline: January 31, 2025 Pricing: 1099 State filing - $0.70/form |

Ready to E-file the 1099 Form with the Vermont State?

Information Required to File 1099 Forms with Vermont

Discover the key information needed to file Form 1099 with the State of Vermont.

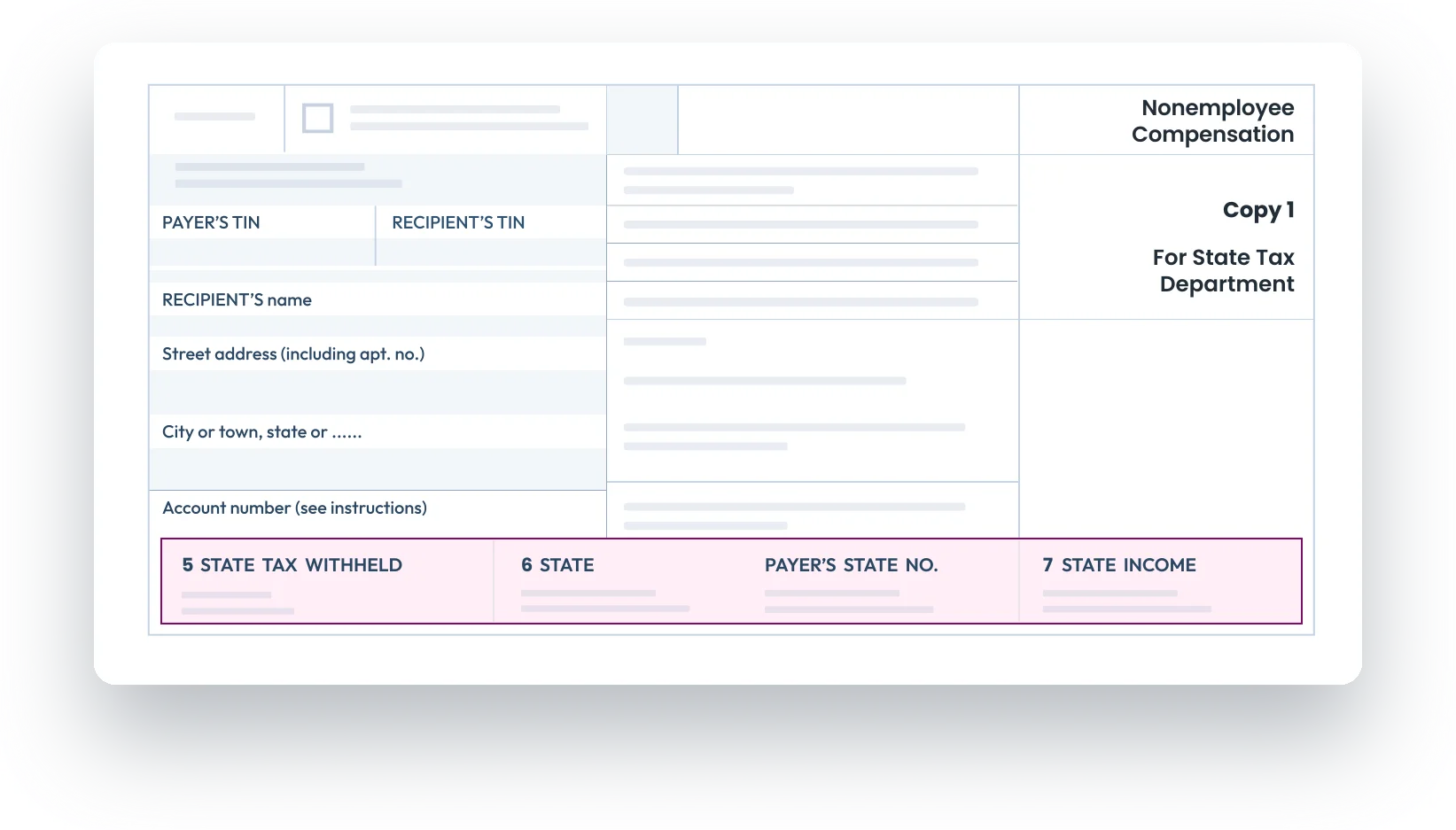

1. State/Payer’s state number

The payer's state identification number refers to the Vermont Withholding Tax Account Number.

Vermont State ID Format: 11 digits - 3 characters WTF followed by 8 digits (Eg: WHT-12345678)

2. Vermont state income

The total amount of taxable income that is subject to Vermont state income tax.

3. Vermont state tax withheld

The total amount of state income taxes withheld from the recipient's income.

If you’ve withheld any Vermont taxes, you must file Reconciliation Form WHT-434.

E-file 1099 with Vermont state in minutes using TaxBandits!

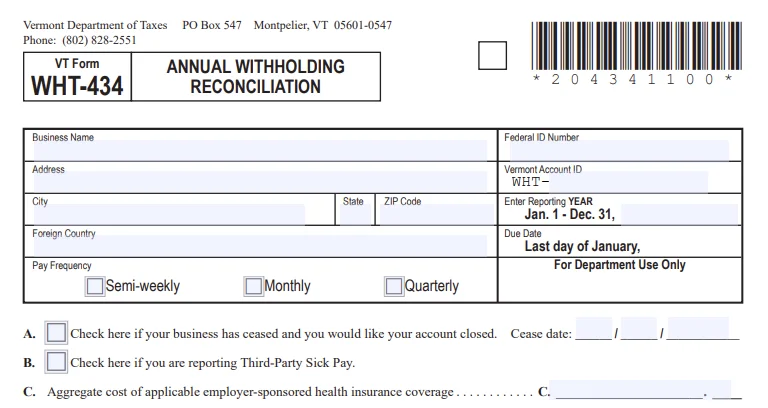

Nonresident Withholding Payment Voucher – Form WHT-434

Form WHT-434 is used to facilitate the submission of withholding tax payments for nonresident individuals or entities that have earned income within the jurisdiction of Vermont.

Information Reported on WHT-434:

- Number of W-2s and 1099s submitted

- Total wage and nonwage payments paid per W-2s and 1099s, respectively.

- Total Vermont tax withheld.

Ready to E-file the 1099 Form with the Vermont State?

TaxBandits – Simplifying Vermont State 1099 Compliance

TaxBandits supports the e-filing of 1099 forms directly with the Vermont Department of Revenue, ensuring compliance with state regulations.

Lowest Pricing

Lowest Pricing

TaxBandits offers the most affordable solution for Vermont 1099 filings, saving you both time and money.

State Filing Guidance

State Filing Guidance

TaxBandits provides step-by-step instructions to effortlessly complete the state 1099 e-filing process from start to end.

State Form PDFs

State Form PDFs

Easily access and download Vermont 1099 form PDFs for filing corrections or record-keeping purposes.

Free Resubmissions

Free Resubmissions

If the Vermont Department of Revenue rejects your 1099 forms, you can correct errors and resubmit them for free.

Start filing your Vermont 1099 returns with TaxBandits by creating an account!

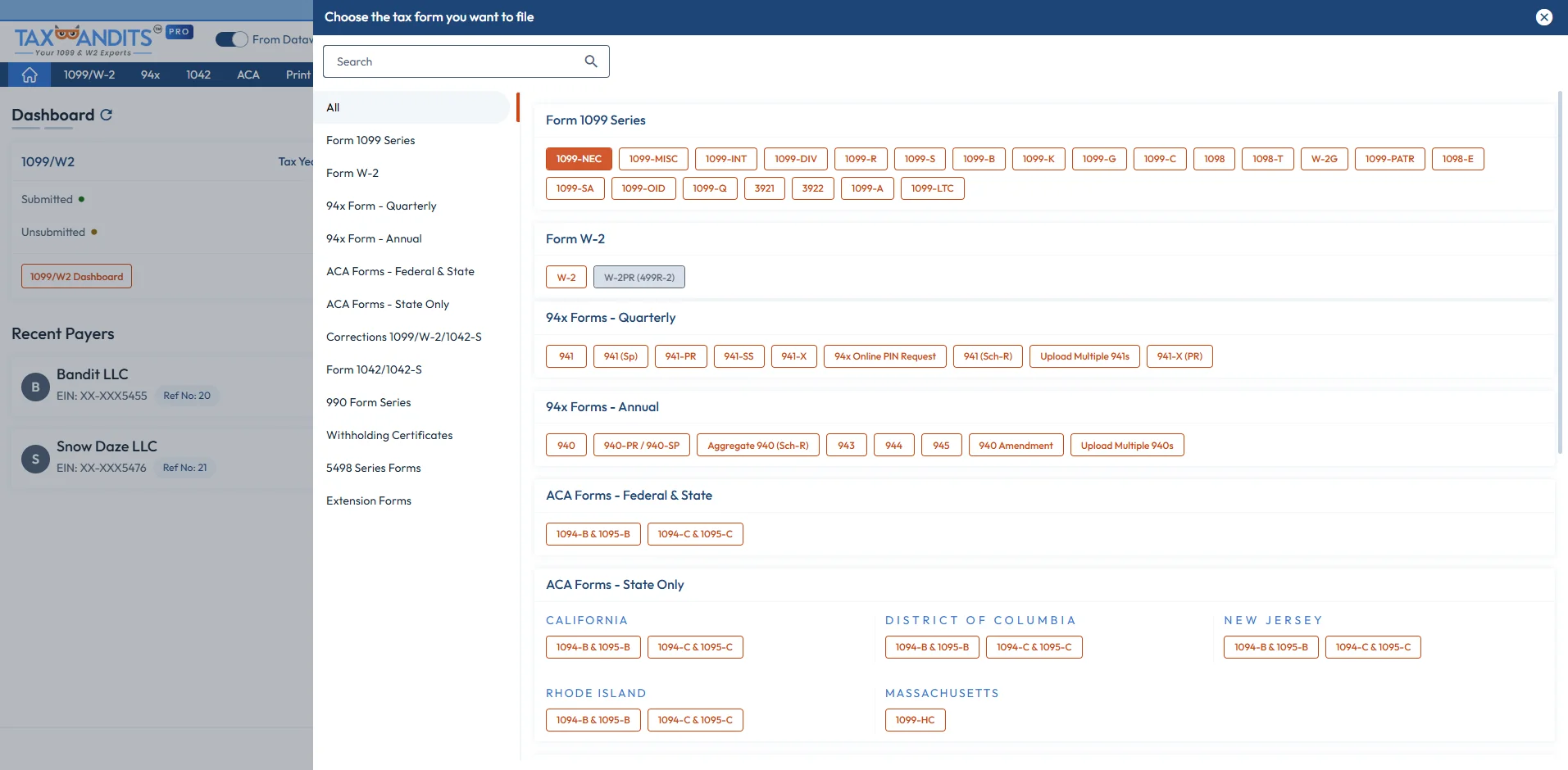

How to File Form 1099 with the State of Vermont?

Create your free account and follow these simple steps to effortlessly e-file your 1099 with the federal and the state of Vermont!

-

Step 1: Choose Form 1099

Select the type of 1099 form you want to file.

-

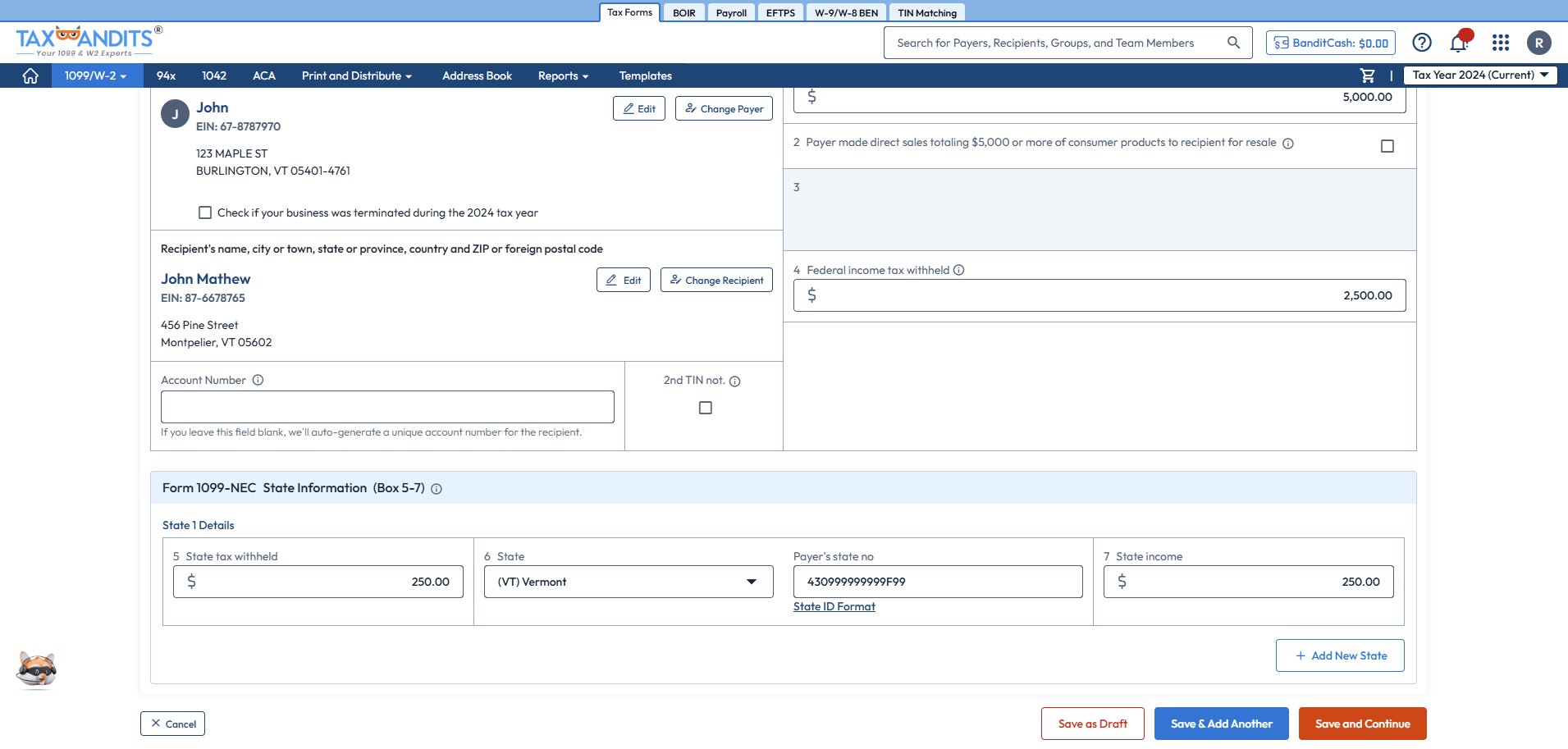

Step 2: Enter Form 1099 details

Complete the form using manual entry or other bulk import options. Ensure you complete the state-specific fields.

-

Step 3: Enter State Filing Information

Provide the required Vermont state details for Form 1099.

-

Step 4: Choose Distribution Options

Opt for our distribution services – Postal Mailing, Online Access, or BanditComplete.

-

Step 5: Review and Transmit

Review your form and transmit it to the IRS and state agencies.

Are you ready to begin e-filing your 1099 Form with Vermont State? File in minutes with TaxBandits!

Frequently Asked Questions

Does Vermont require 1099 filing?

Yes, the state of Vermont requires you to file 1099 forms if there was state tax withholding.

- Required when the payment reported was subject to Vermont withholding (i.e., when VT state tax withheld).

- Required when payment was made to a nonresident of Vermont for services performed in Vermont.

Does Vermont have a specific payment threshold for Form 1099 filing?

No, Vermont does not have a specific payment threshold for reporting Form 1099. Reporting requirements in the state align with federal guidelines. Payers are required to assess and file a Form 1099 based on the applicable federal threshold for each specific form. Below are the various Federal thresholds for

Form 1099.

| 1099 Forms | Federal Threshold |

|---|---|

|

Form 1099-NEC Form 1099-MISC |

$600 |

| Form 1099-K | $5000 |

|

Form 1099-INT |

$10 for the amount reported on Boxes 1, 3, or 8 (or at least $600 of interest paid for trade or business) |

| Form 1099-DIV |

|

| Form 1099-R | $10 |

| Form 1099-B | - |

| Form 1099-G | - |

| Form 1099-OID | - |

What types of 1099 forms does Vermont require?

Vermont requires the filing of the following 1099 forms directly with the state only if there is state tax withholding:

Does Vermont require additional forms when filing 1099?

Yes, Vermont requires the following Withholding Tax Reconciliation Form along with your 1099.

Form WHT-434 (Annual Withholding Reconciliation) is an Annual Employer Reconciliation report used to report withholding tax returns for employers.

- When e-filing, you are required to complete Form WHT-434 with your 1099. Here at TaxBandits, we simplify the e-filing of 1099.

- When paper filing, you must include both Form WHT-434 and 1096.

When you efile 1099 with TaxBandits, you need to take care of Form WHT-434.

When is Vermont 1099 due?

The filing deadline for Form 1099, Form WHT-434 is January 31. If this due date falls on a weekend or federal holiday, the next business day will be the deadline.

For the 2024 tax year, the deadline for filing 1099 Forms with Vermont is January 31, 2025.

What are the requirements to file 1099 electronically with Vermont?

The Commissioner of Taxes has mandated the electronic filing of 1099 and Form WHT-434. The mandate is effective for all payroll filing services, paid preparers, and employers who will remit 25 or more 1099 forms. Employers with fewer than 25 forms are encouraged to file electronically.

What are the penalties for not filing or filing 1099 late with Vermont?

Vermont imposes penalties if you file 1099 late and/or don’t pay the state taxes on time.

- Penalties for filing 1099 late You will be charged 5% of the unpaid taxes each month you are late until you file. If you file 1099 after 60 days from the original deadline, the penalty would be $50.

- Penalties for reporting incorrect tax liability intentionally 100% of your unpaid taxes

Where do I mail the Vermont 1099 forms?

Mail your Form 1099s along with Form WHT-434 to the following address.

Vermont Department of Taxes,

PO Box 547,

Montpelier,

VT 05601-0547.

If you need to correct Vermont 1099 forms, update the necessary information on the already filed 1099 through TaxBandits. Then, download the form and send it to the email mentioned above.

For more information, click here to learn about Vermont 1099 filings.

Success Starts with TaxBandits

The Smart Business Owners Choice

Vermont State Filing

How to File 1099 Forms with TaxBandits

Select Form 1099

Start by selecting Form 1099 from your dashboard. With TaxBandits, you can file this form for both the current and previous tax years.

Enter the required information

Fill out the required 1099 information and the respective state information in the appropriate fields.

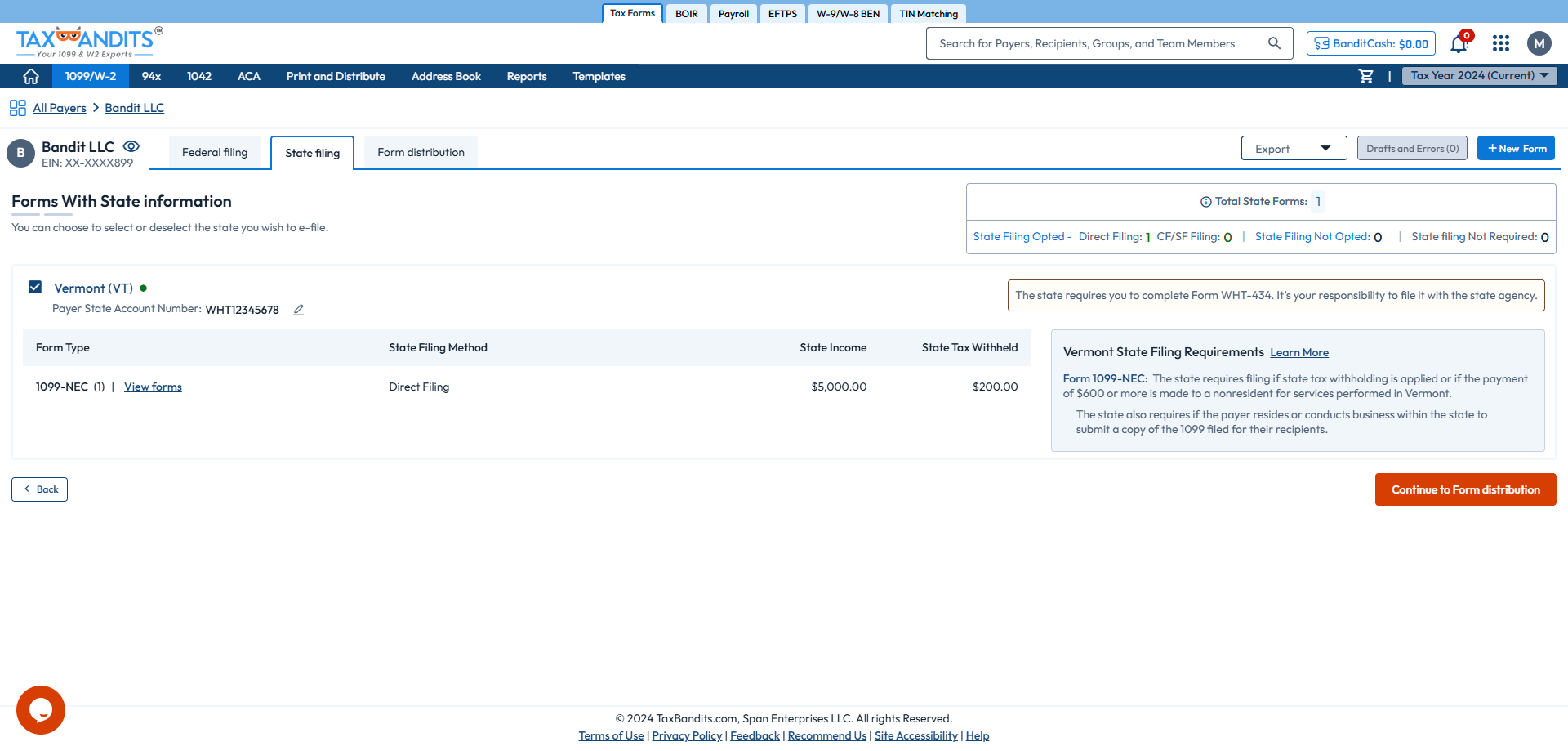

Review State Filing Information

Review your state filing information and click "Continue to form disturibution" to proceed further.

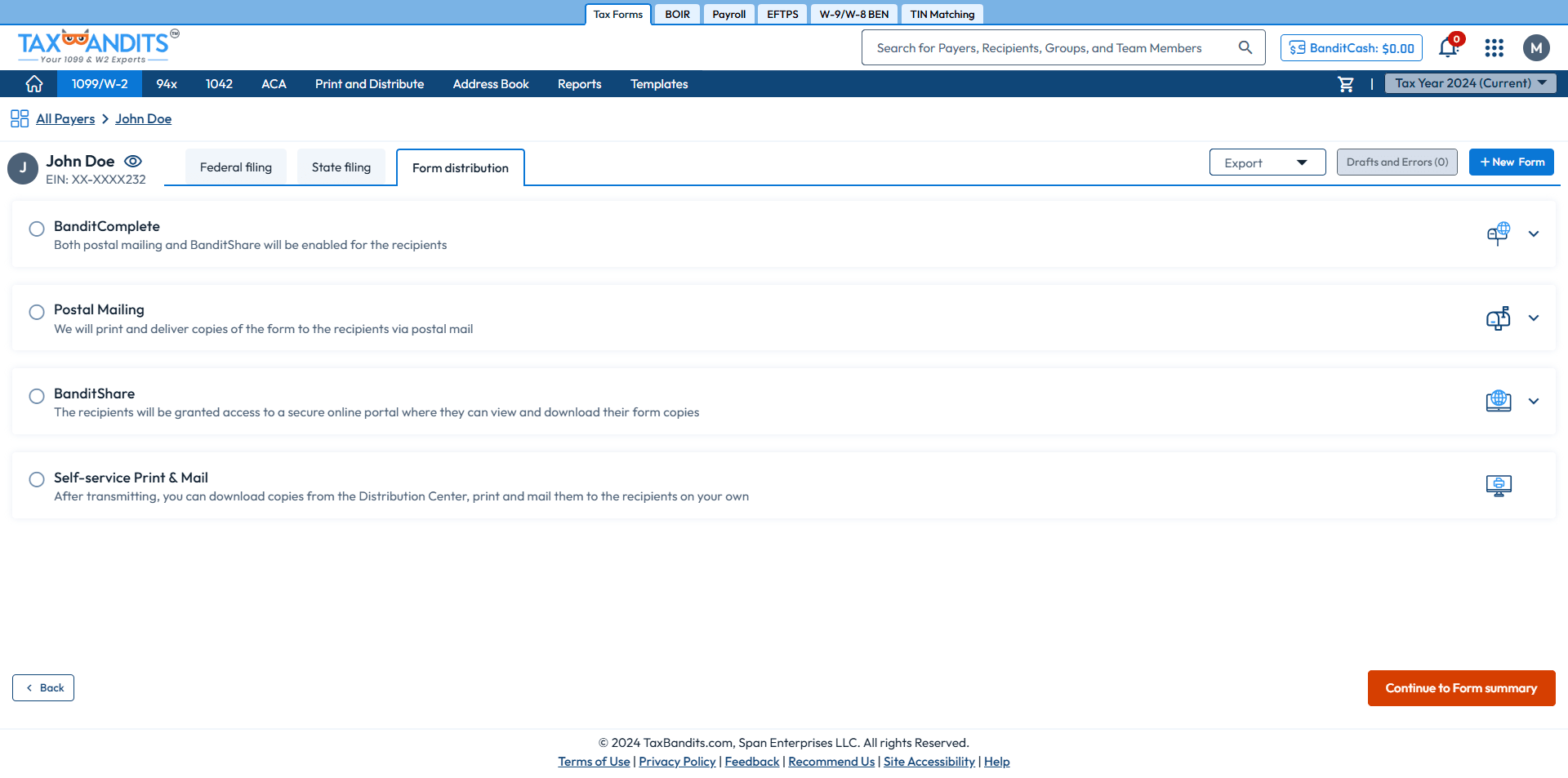

Choose Distribution Options

Select how you'd like to distribute recipient copies: via mail, online access, or with the BanditComplete option.

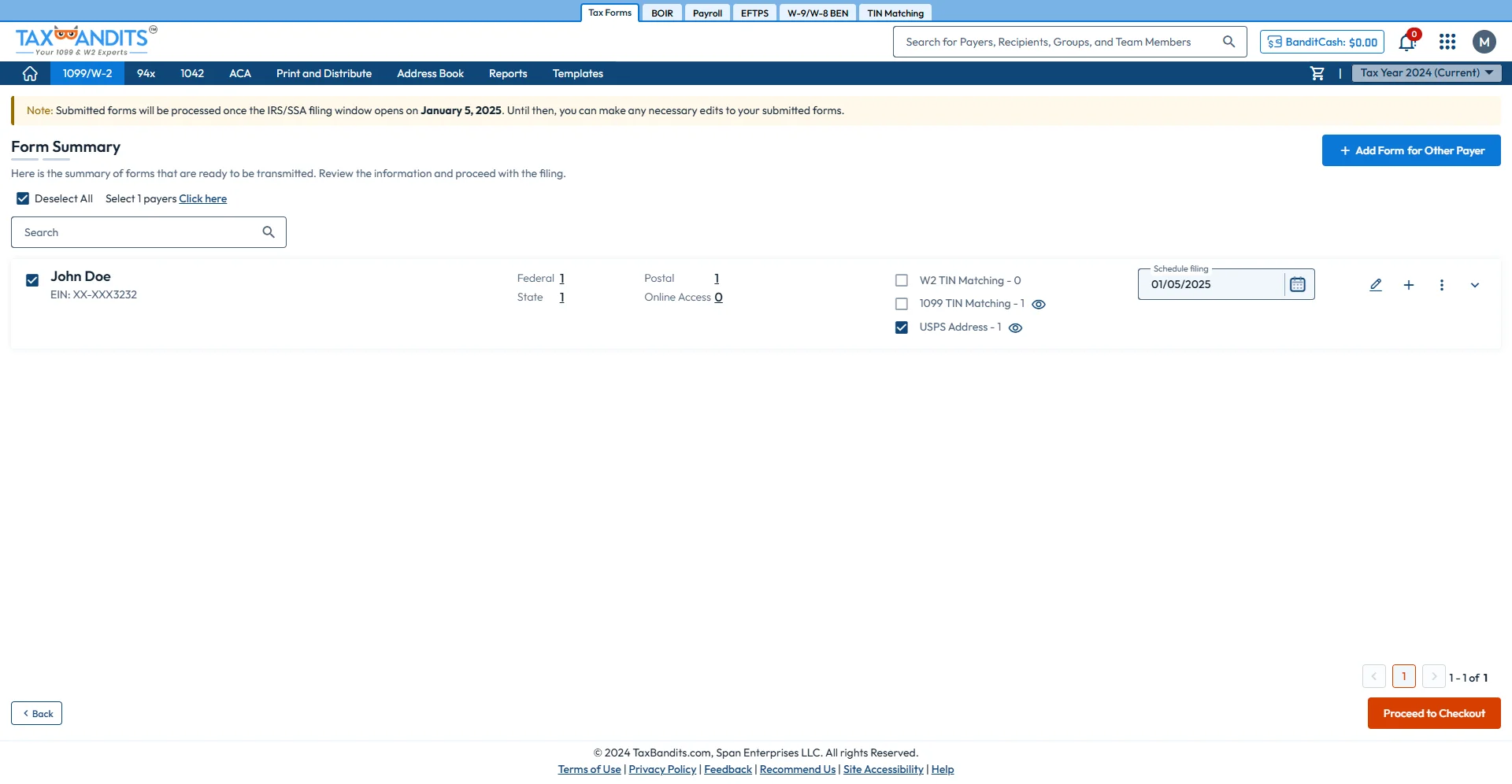

Review Form 1099 Information

Review the information and make any necessary changes if needed.

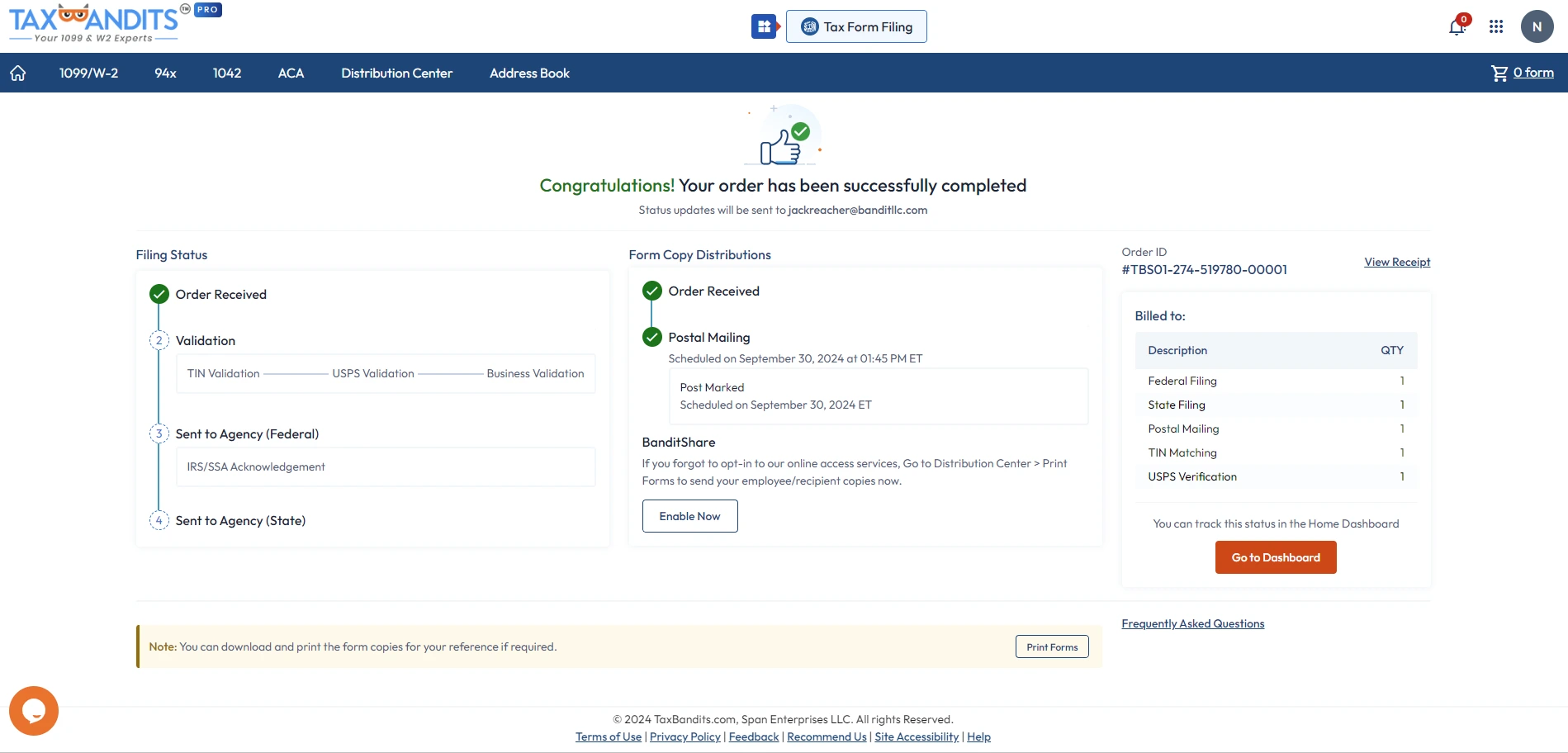

Transmit the Form to the IRS/State

After reviewing, transmit the completed Form 1099 to the IRS and state.