How to E-file Form 5498-SA with TaxBandits

What Information is Required to E-File Form 5498-SA Online?

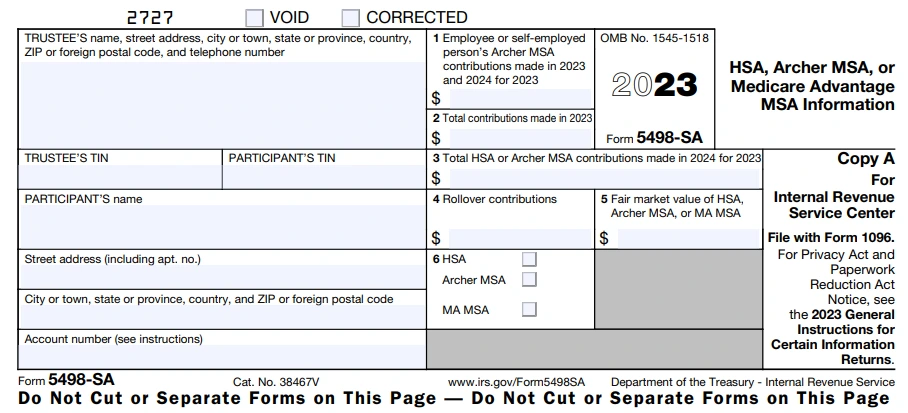

Trustees Details: Name, TIN, Address, and Contact Information

Participant’s Details: Name, TIN, Address, and Contact Information

- Contribution Details

- Fair Market Value (of HSA, Archer MSA, MA MSA)

- Type of account

Are you ready to file your 5498-SA Form? Get started with your free TaxBandits account!

Visit https://www.taxbandits.com/form-5498-series/form-5498-sa-instructions/ to know more.

Discover exceptional features that will help you file your 5498-SA with ease.

Deliver Recipient Copies

To distribute the recipient copies of your 5498-SA, you can use our postal mail or online

access options.

Internal Audit Check

TaxBandits validates that your completed 5498-SA Form follows the IRS business rules, guaranteeing accurate filing.

Access to Form Copies

You can access your Form copies anytime. TaxBandits securely keeps a record of the copies of your transmitted forms that have been transmitted for 7 years.

Real-Time Notifications

You will receive an email notification instantly regarding the status of your Form 5498-SA.

PRO Features-Exclusive E-file Solution designed specifically for Tax Pros

Staff Management

Invite your team members to prepare and submit the 5498-SA filings for our clients. Assign them the task accordingly.

Client Management

Handle 5498-SA filings for various clients, each with unique TINs, and provide access to a secure portal for client review

before submission.

Additional User Access

TaxBandits allows you to allot specific roles to unlimited users within a single account, optimizing account management and facilitating seamless collaboration.

Success Starts with TaxBandits!

Frequently Asked Questions

What is Form 5498-SA?

IRS Tax Form 5498-SA is an informational form that reports the total contributions made towards a Health Savings Account (HSA), Archer Medical Savings Accounts (MSA), and Medical Advantage MSA (MA MSA) to the IRS. You are required to file if you are the trustee or custodian of an HSA, Archer MSA, or MA MSA with a separate form for each type of plan. You must report the receipt of a rollover from one Archer MSA to another Archer MSA, and receipt of a rollover from an Archer MSA or an HSA to an HSA.

Note: Do not report a trustee-to-trustee transfer from one Archer MSA or MA MSA to another Archer MSA or MA MSA, one Archer MSA to an HSA, or from one HSA to another HSA. For reporting purposes, contributions and rollovers do not include these types of transfers. You are not required to file Form 5498-SA if a total distribution was made from an HSA or Archer MSA during the year and no contributions were made for that year. To learn more about Form 5498-SA, visit irs.gov.

Are you ready to report your 5498-SA Form? Get started with TaxBandits.

Start E-Filing Now

When is Form 5498-SA E-Filing Deadline for 2023 Tax Year?

The Form 5498-SA due to the participant (Other types of IRAs) is by May 31, 2024.

The deadline for E-filing Form 5498-SA with the IRS is May 31, 2024.

What are the changes to the IRS Reporting after the Death of the Account Holder?

In the year an HSA, Archer MSA, or MA MSA owner dies, generally you must file a Form 5498-SA and furnish a statement for the decedent. If the designated beneficiary is the surviving spouse, the following will apply.

- The spouse becomes the account holder of the HSA or Archer MSA.

- An MA MSA is treated as an Archer MSA of the spouse for distribution purposes, but no new contributions may be made to the account.

If the designated beneficiary is not the spouse or there is no designated beneficiary, the account ceases to be an HSA, Archer MSA, or MA MSA.

Helpful Resource for Form 5498 SA