Revised IRS Form 941 For Q2 & Q3 2022

Know the Changes in New IRS Form 941 for the 2nd & 3rd Quarter of 2022

Updated on January 26, 2023 - 10:30 AM by Admin, TaxBandits

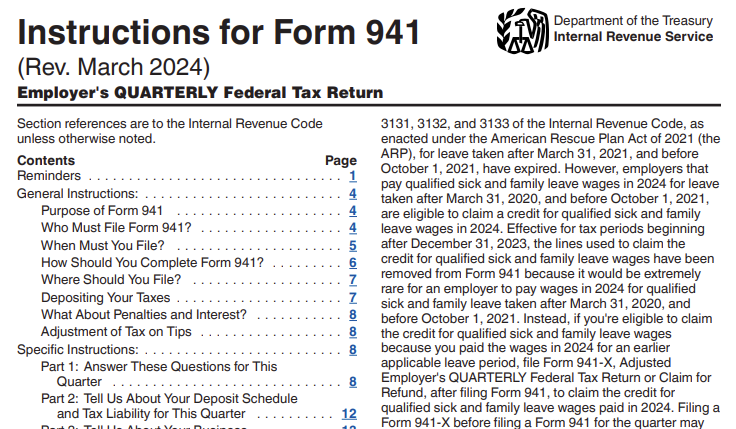

IRS has released an updated Form 941 for the second & third quarter of 2022, there are a few notable changes that employers will need to be aware of Employers who are required to report federal income taxes, social security taxes, or medicare taxes withheld from their employees' paychecks must submit the new revised IRS Form 941 for 2022.

This article provides detailed information on the Form 941 changes for Q2 & Q3, 2022.

1. An Overview of the New Form 941 for Q2, & Q3, 2022

The tax relief programs that were passed under the American Rescue Plan Act are continuing to expire, the Form 941 for the second and third quarter of 2022 will reflect these changes.

The removal of lines that gathered information related to the COBRA Premium Assistance Credit are one of the most visible changes to the form. It is evident that the COBRA Premium Assistance Credit will not be used on the Form 941 for the second and third quarter of 2022.

2. How have the New Form 941 fields been revised for Q2 & Q3 of 2022?

Now that the COBRA Premium Assistance Credit is no longer available, the following 2022 Q2 & Q3 Form 941 fields have been updated.

| Line No. | 2022 Q1 Form 941 | 2022 Q2 & Q3 Form 941 |

|---|---|---|

| 11e | Non Refundable portion of COBRA premium assistance credit (see instructions for applicable quarter) . | Reserved for future use |

| 11f | Number of individuals provided COBRA premium assistance | Reserved for future use |

| 11g | Total nonrefundable credits. Add lines 11a, 11b, 11d, and 11e | Total nonrefundable credits. Add lines 11a, 11b, and 11d . |

| 13f | Refundable portion of COBRA premium assistance credit (see instructions for applicable quarter) | Reserved for future use |

| 13g | Total deposits and refundable credits. Add lines 13a, 13c, 13e, and 13f . | Total deposits and refundable credits. Add lines 13a, 13c, and 13e |

TaxBandits, an IRS authorized e-file provider, offers an easy efiling solution for 941 filing for 2022 at the lowest price of just $5.95/form. E-file 941 Now!

3. When is the Deadline to File Form 941 for 2022?

Form 941 is a quarterly form with four deadlines, this table contains all of the 941 deadlines for 2022. The deadline for the third quarter is set for October 31, 2022.

| Quarter | Reporting Period | Due Date |

|---|---|---|

| Quarter 1 | Jan, Feb, and Mar | May 2, 2022 |

| Quarter 2 | Apr, May, and Jun |

August 1, 2022 |

| Quarter 3 | Jul, Aug, and Sep | October 31, 2022 |

| Quarter 4 | Oct, Nov, and Dec | January 31, 2023 |

4. E-file 941 for Q2 & Q3 2022 with TaxBandits in minutes

Filing Form 941 electronically for 2022 is a better option than filing a paper copy with the IRS. The IRS actually prefers e-filing because they are able to process these forms at a faster pace. In addition to being more efficient, when you e-file Form 941 for 2022 with TaxBandits, you receive instant updates on the IRS status of your form.

When filing a paper copy of Form 941 it is easy to make common mistakes. When you e-file with TaxBandits, your form is checked for errors using the IRS Business Rules. Follow the simple steps to e file form 941 for 2022 with TaxBandits.

- Sign in to create a free TaxBandits account!

- Choose "Form 941" and enter the details.

- Review and Transmit to the IRS.

TaxBandits also offers great features like zero tax filing and Schedule B. Begin e-filing Form 941 for the second and third quarter of 2022 with TaxBandits.