If you are an employer, you must file Form 941 for each quarter. Before you File your Form 941 for 2024, you must be aware of the changes in Form 941 to stay compliant.

Looking for Form 941 for the 2024 tax year?

Complete your Form 941 filing in just a few minutes with TaxBandits.

Simply create a free account, enter your information, and e-file it with the IRS. Once done, you can download PDF copies for your reference.

Form 941 for the 2025 tax year is now available. With TaxBandits, you can file Form 941 for both 2024 and 2025!

This article provides detailed information on Form 941 changes for the 2024 tax year.

Table of Contents:

- What are the changes to Form 941 for 2024?

- When is the deadline to file Form 941 for 2024?

- How to file Form 941 for 2024?

What are the changes to Form 941 for 2024?

There are some major changes to Form 941 for 2024. The following changes are made for the 2024 tax year:

- The Social Security wage base limit has now been increased from $160,200 to $168,600.

- Social Security and Medicare taxes apply to the wages of household workers who are paid $2,700 or more in 2024.

- Election workers who receive $2,300 or more in cash or its equivalent form of compensation are subject to Social Security and Medicare taxes in 2024.

- Businesses can no longer claim COVID-19-related credits for qualified sick and family leave wages on Form 941.

- Form 941-SS and 941-PR are discontinued after 2023. Instead, employers in those U.S territories have the option to file using Form 941 or if they prefer a Form in Spanish, they can file using the new Form 941(sp).

- Publications- 51, 80, and 179 are no longer required after 2023. Instead, information necessary for agricultural employers and employers in U.S Territories will be included in Publication 15 (Employer's Tax Guide). Also, a Spanish version of Publication 15 has been introduced starting from 2024.

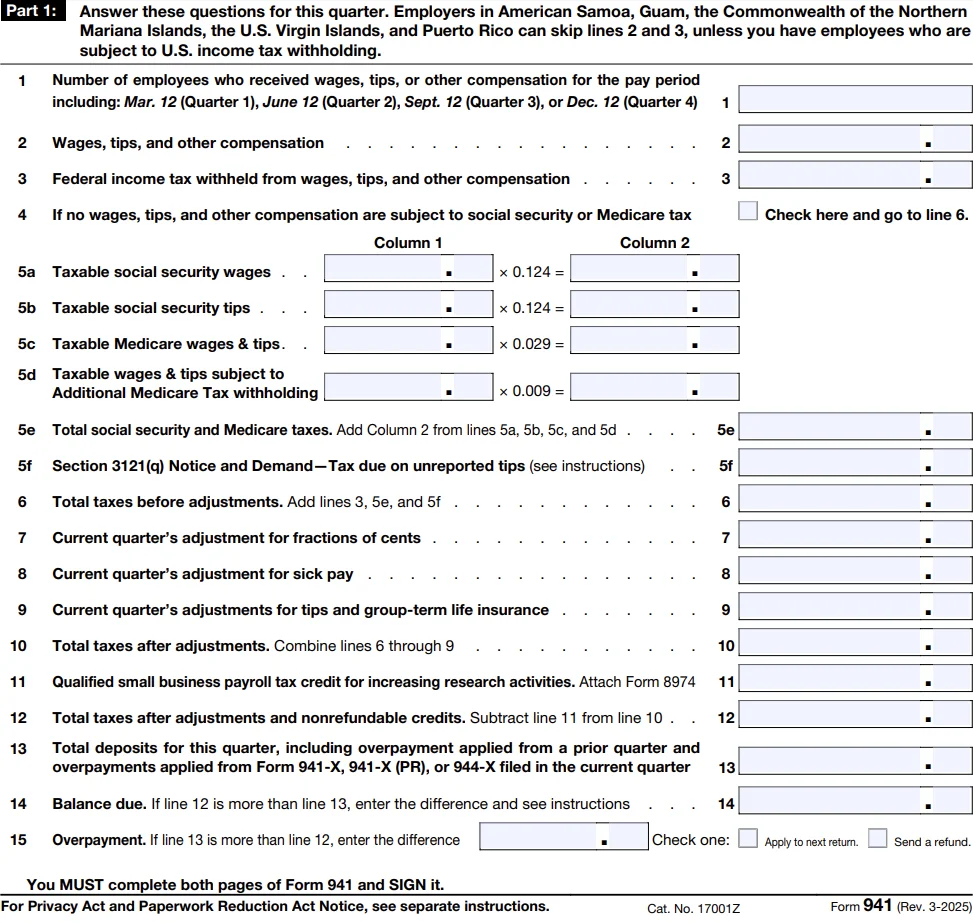

Certain lines have been removed from Form 941 for 2024:

| Section | Removed Lines | New Changes for 2024 |

|---|---|---|

|

Part 1 |

Lines 11a - 11g |

Line 11 now includes information about Form 8974 (Payroll Tax Credit for Qualified Small Businesses for Increasing Research Activities). |

|

Lines 13a - 13i |

Line 13 now reports the total sum of deposits for the quarter, including overpayments applied from a prior quarter and those from Forms 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter. |

|

|

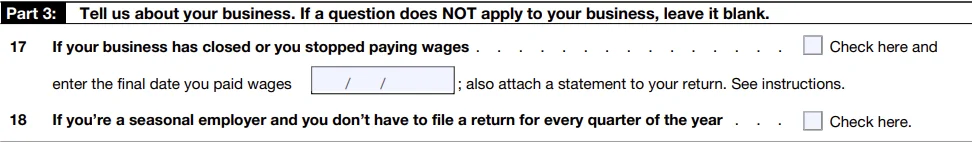

Part 3 |

Lines 19 - 28 |

These lines are removed as COVID-19-related credits can no longer be claimed using Form 941 for 2024. |

Updated Form 941 for 2024: Part 1 and Part 3:

When is the deadline to file Form 941 for 2024?

Form 941 must be filed every quarter while your business is in operation. The Form 941 due dates are April 30, July 31, October 31, and January 31. If you withhold taxes from your employees, they must be deposited with the IRS according to your deposit schedule. Read our article on Form 941 deposit due dates for more details.

How to file your 941 Form for 2024?

The quickest and most secure way to file Form 941 is through an IRS-authorized e-file provider.

As an employer, you can e-file Form 941 for both the 2024 and 2025 tax years, ensuring IRS compliance and

hassle-free processing.

While mailing Form 941 is an option, it comes with complexities. The Form 941 mailing address varies based on your business location and whether you're submitting a payment with your return.

To avoid delays, the IRS recommends e-filing for faster and more secure processing.

Get started today with TaxBandits, an IRS-authorized e-file provider that simplifies your filing with automatic tax calculations, and error checks using the IRS Business Rules, built-in worksheets, 941 Schedule B, and Form 8974. Complete your Form 941 in 3 simple steps:

- Enter Form Information

- Review and e-sign your return

- Tranmit it to the IRS

Looking to know more about the TaxBandits filing solution?

Master Form 941 Filing with Ease!

A complete guide to help business owners stay compliant.

The guide includes:

- An overview of Form 941

- Key deposit deadlines

- Filing methods, tips, and more

Related Topics