Alabama Form W-2 & A-3 Filing Requirements for 2024

Meet your Alabama W-2 filing requirements efficiently with TaxBandits!

Lowest Pricing in the Industry - E-file at just $0.70/form

Simplify Your Alabama W-2 Filing

with TaxBandits!

- E-file your Alabama W-2 in minutes

- Includes Reconciliation Form A-3 for Free

-

Supports Alabama W-2 Corrections -

Easily

correct, print, and mail to the state -

Retransmit rejected Alabama W-2 returns

at no extra cost

-

Default State

- Filing Criteria

- Information Required

- How to File

- FAQs

Alabama W-2 Filing Criteria

The State of Alabama requires W-2 filing, even if no state tax is withheld.

| Filing Criteria | Form W-2 |

|---|---|

|

Criteria 1 If there is Alabama state tax withheld |

Filing Method: Direct State Filing Additional Form: Form A-3 Deadline: January 31, 2025 Pricing: W-2 State Filing - $0.70/form |

|

Criteria 2 If there is no Alabama State Tax Withholding |

Filing Method: Direct State Filing Additional Form: Not Required Deadline: January 31, 2025 Pricing: W-2 State Filing - $0.70/form |

| Criteria | Filing Requirement | Additional Requirement | Due Date |

|---|---|---|---|

|

If there is any Alabama state tax withheld |

You must file a W-2 directly with E-file with TaxBandits |

Reconciliation Form A-3 |

January 31, 2025 |

If there is no Alabama State Tax Withholding |

You must file a W-2 directly with E-file with TaxBandits |

No additional form is required |

January 31, 2025 |

Ready to start filing W-2s with Alabama?

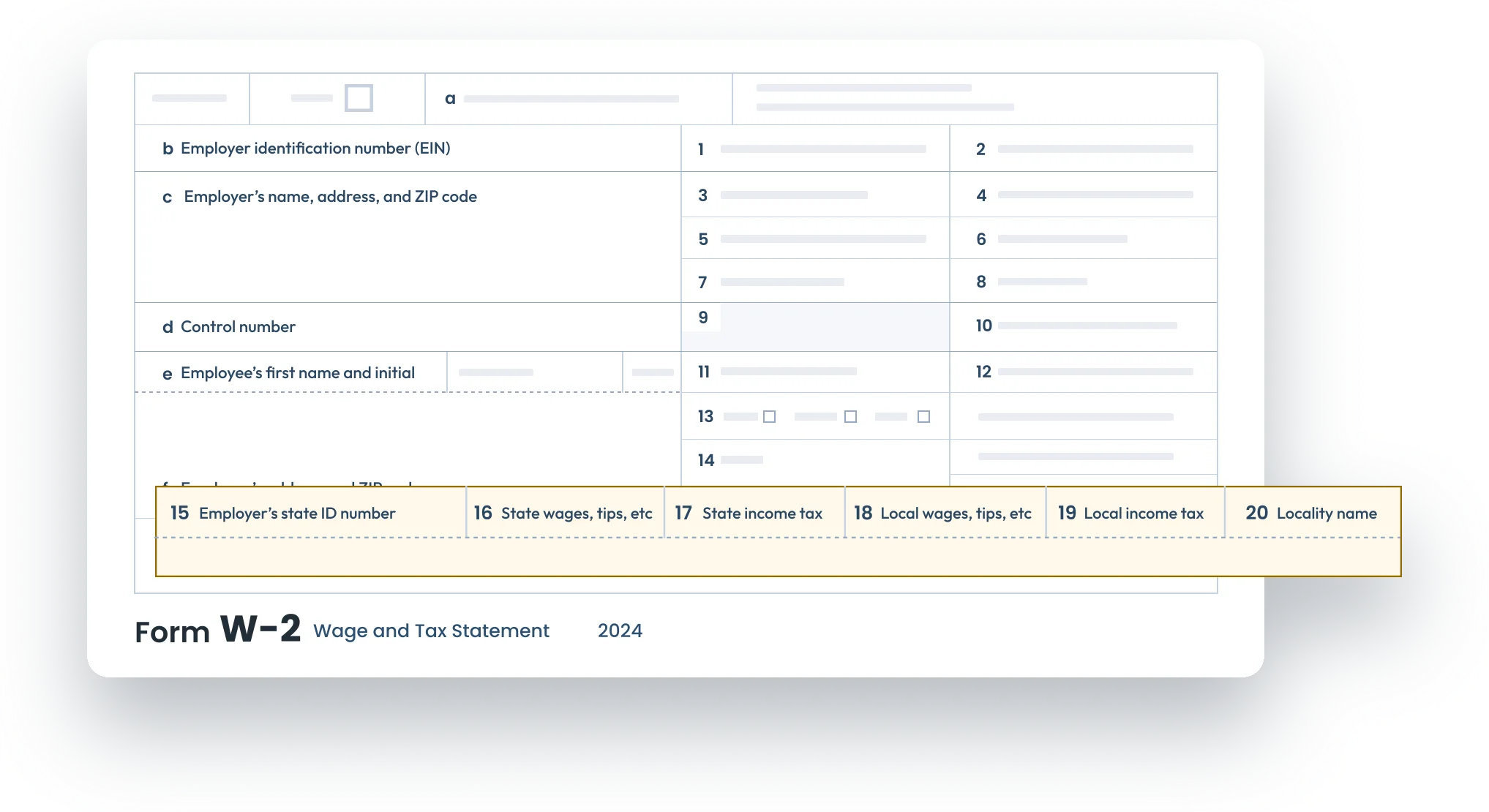

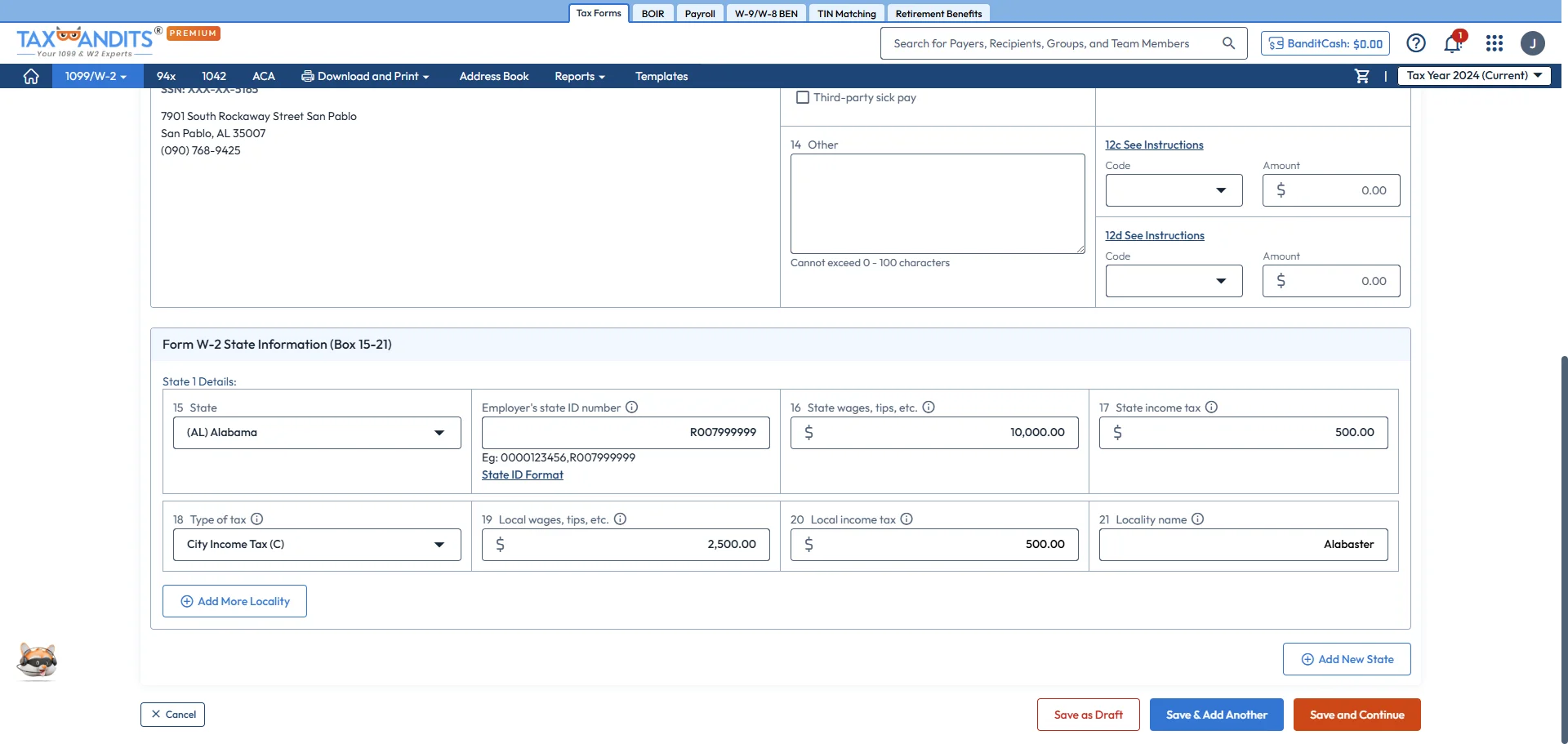

Information Required to File W-2 Forms with Alabama

1. Employer’s state ID number

The employer's state identification number refers to the Alabama Withholding Tax Account Number.

Alabama State ID Format:

- 10-Digit Numeric Format: A sequence of 10 digits. Example: 0000123456

- "R" Prefix Format: The letter "R" followed by 9 digits. Example: R007999999

2. Alabama state/local wages

The total amount of taxable wages, tips, that is subject to Alabama state or locality income tax.

3. Alabama state/local tax withheld

The total amount of state or locality income taxes withheld from the employee’s wages.

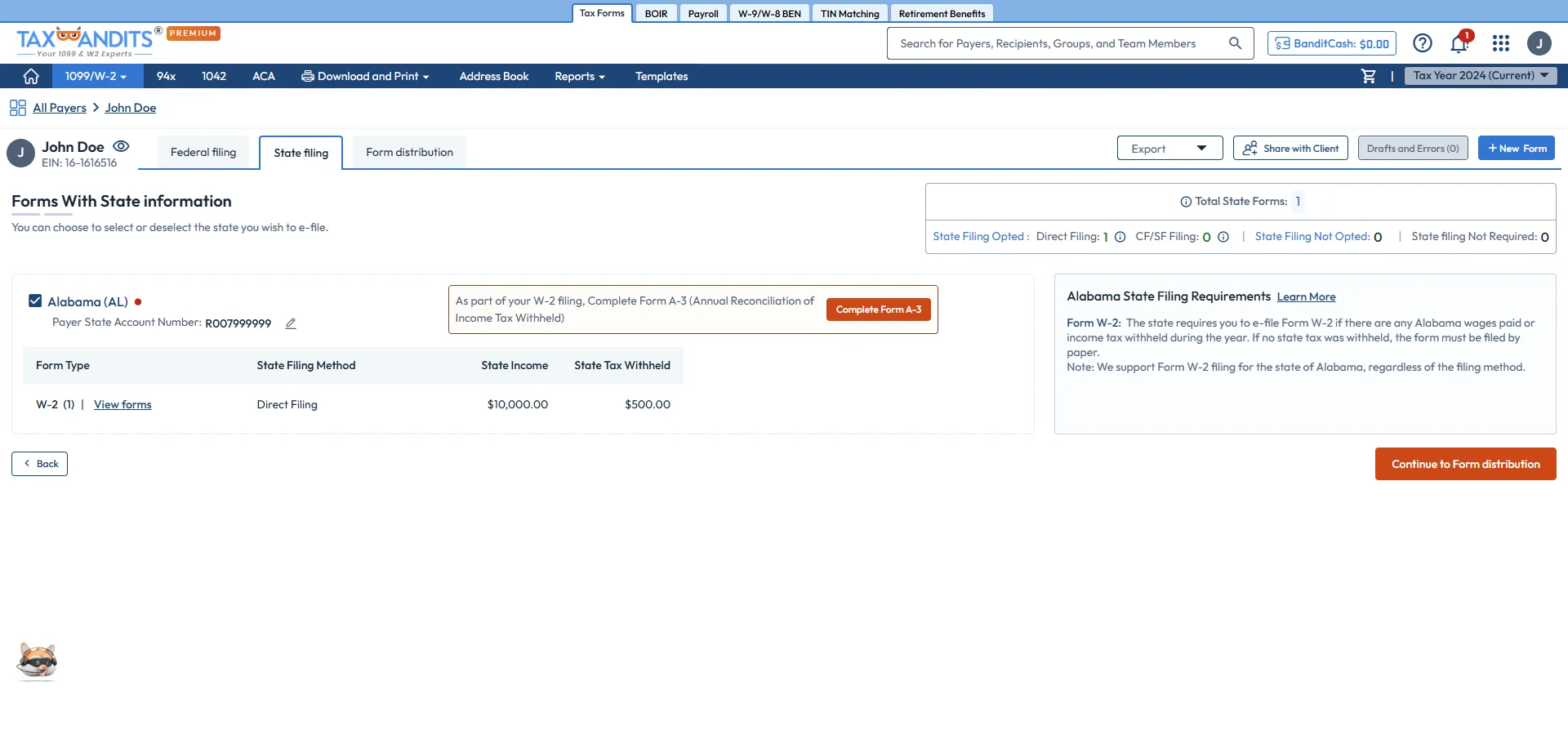

If you’ve withheld any Alabama taxes, you must file Reconciliation Form A-3.

E-file W-2s to the State of Alabama in minutes with TaxBandits!

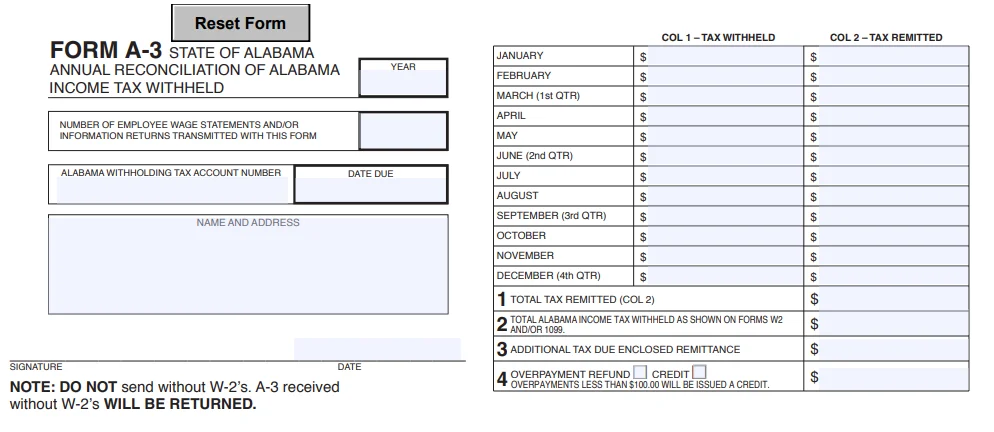

Alabama Annual Reconciliation Form A-3

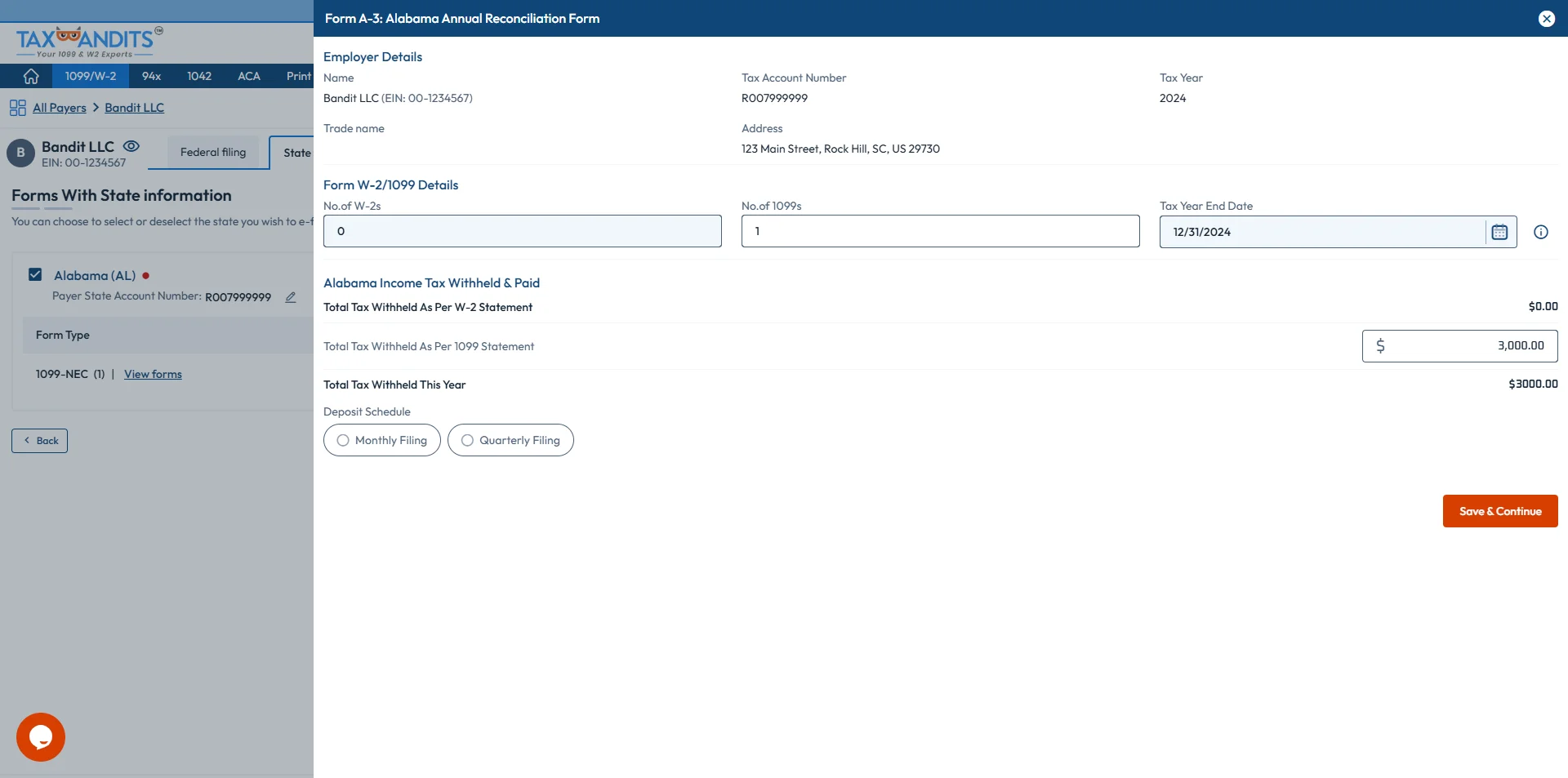

Form A-3 is an Annual Reconciliation used to report the total income taxes withheld from employees and taxes remitted to the state. It's also used to claim an overpayment refund or pay if the taxes are underpaid.

Information Reported on A-3:

- Monthly Alabama income tax withheld (or quarterly amounts if applicable)

- Actual Alabama withholding tax remitted, including credits from prior years

- Total Alabama income tax withheld on W-2s (or 1099s)

-

Overpayment or underpayment based on a comparison between Block 1

and Block 2

E-file W-2 with Alabama state in minutes using TaxBandits!

TaxBandits – Simplifying Alabama State W-2 Compliance

TaxBandits supports the e-filing of W-2 forms directly with the Alabama Department of Revenue, ensuring compliance with state regulations.

Lowest Pricing

Lowest Pricing

TaxBandits offers the most affordable solution for Alabama W-2 filings, saving you both time and money.

Free Reconciliation Form (A-3)

Free Reconciliation Form (A-3)

We provide Form A-3, at no additional cost, making year-end reconciliation simple and stress-free.

State Form PDFs

State Form PDFs

Easily access and download Alabama W-2 form PDFs for filing corrections or record-keeping purposes.

Free Resubmissions

Free Resubmissions

If your W-2 forms are rejected by the Alabama Department of Revenue, you can correct errors and resubmit them for free.

Create a TaxBandits account to start filing your Alabama W-2 returns!

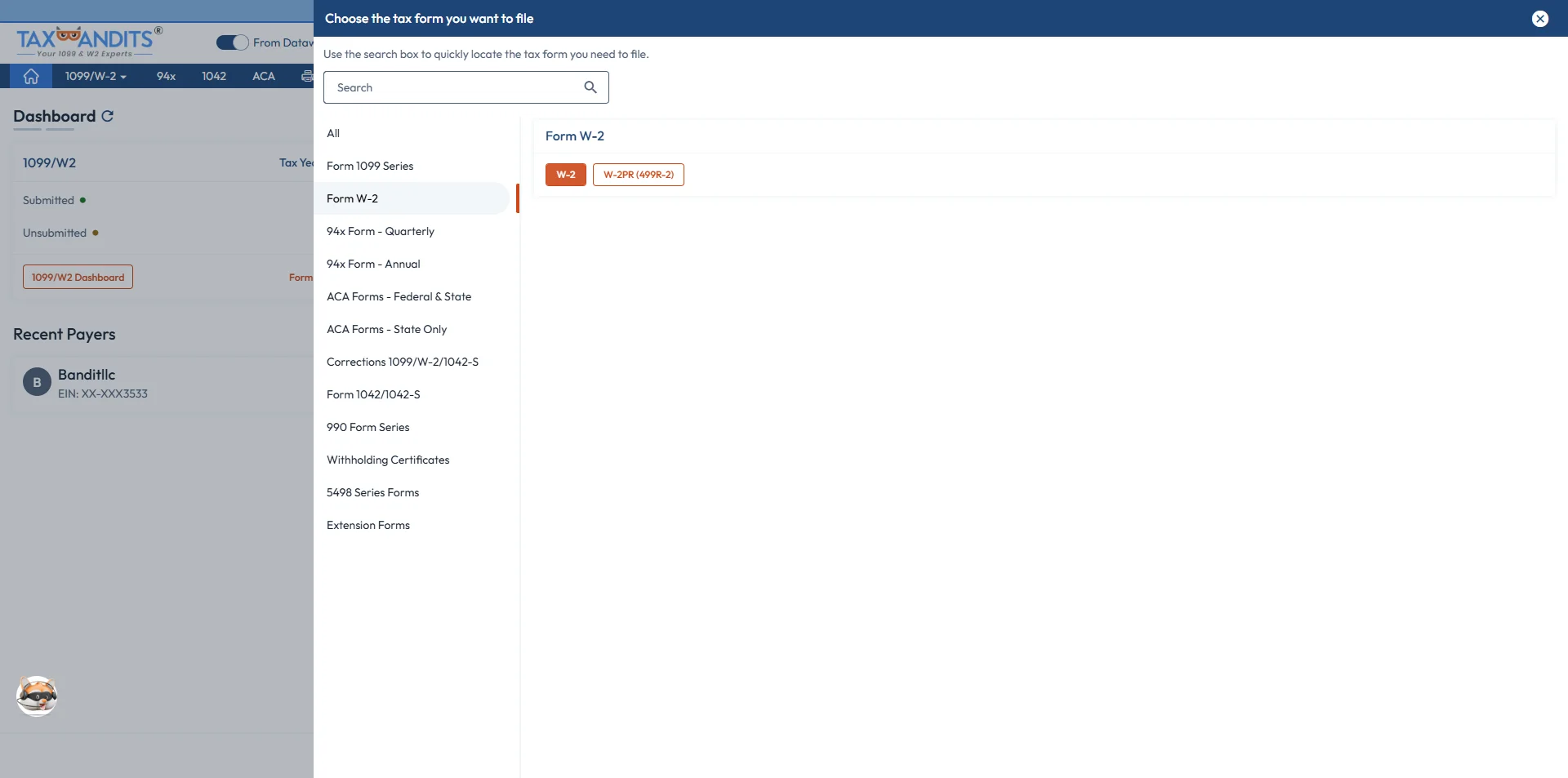

How Is Form W-2 Filed with the State of Alabama?

Create your account and follow these steps to easily e-file your W-2s with the SSA and State of Alabama!

-

Step 1: Choose Form W-2

Select the type of W-2 form you want to file.

-

Step 2: Enter Form W-2 details

Complete the form using manual entry or other bulk import options. Ensure you complete the state-specific fields.

-

Step 3: Complete Reconciliation Form (A-3)

Provide the necessary withholding information to complete Form A-3.

-

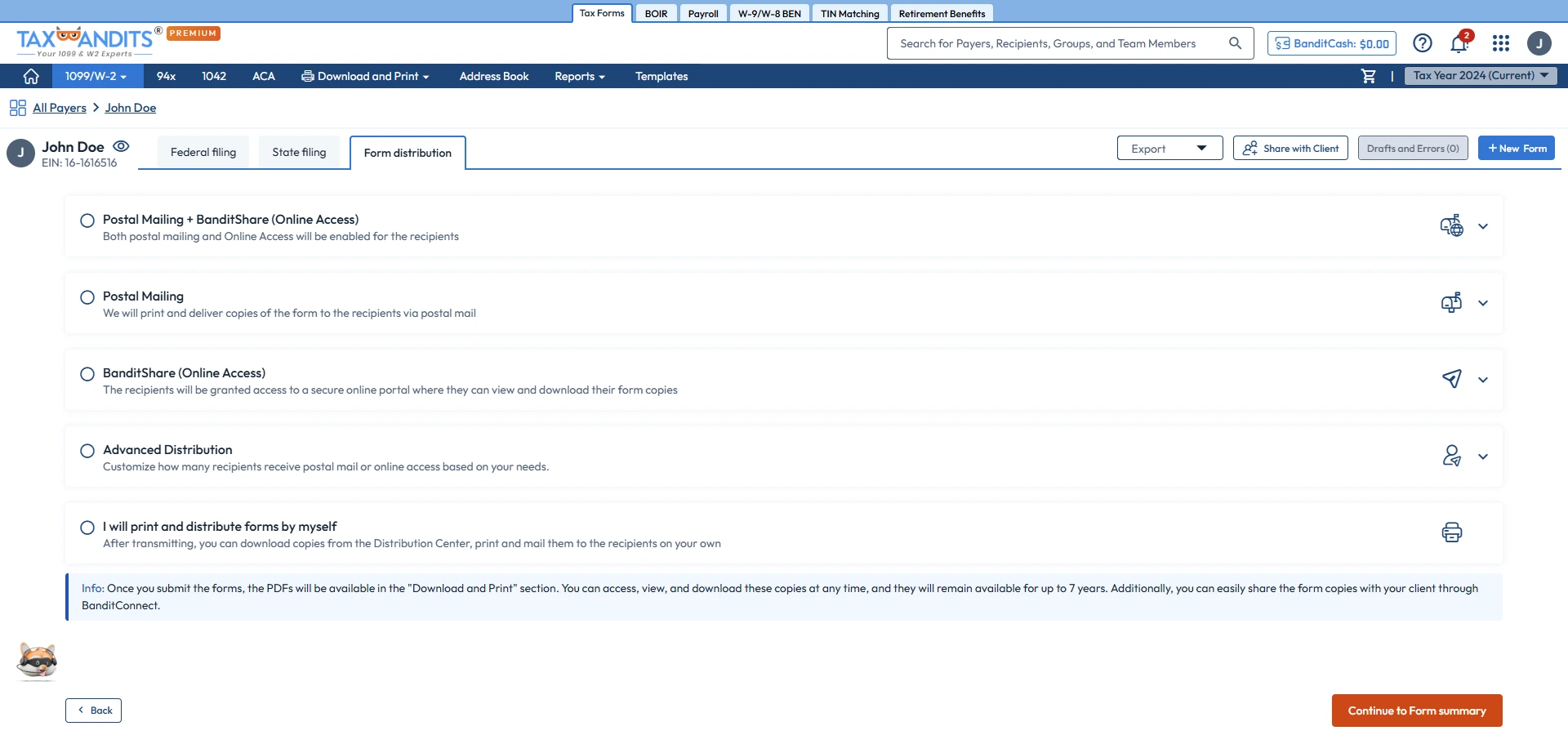

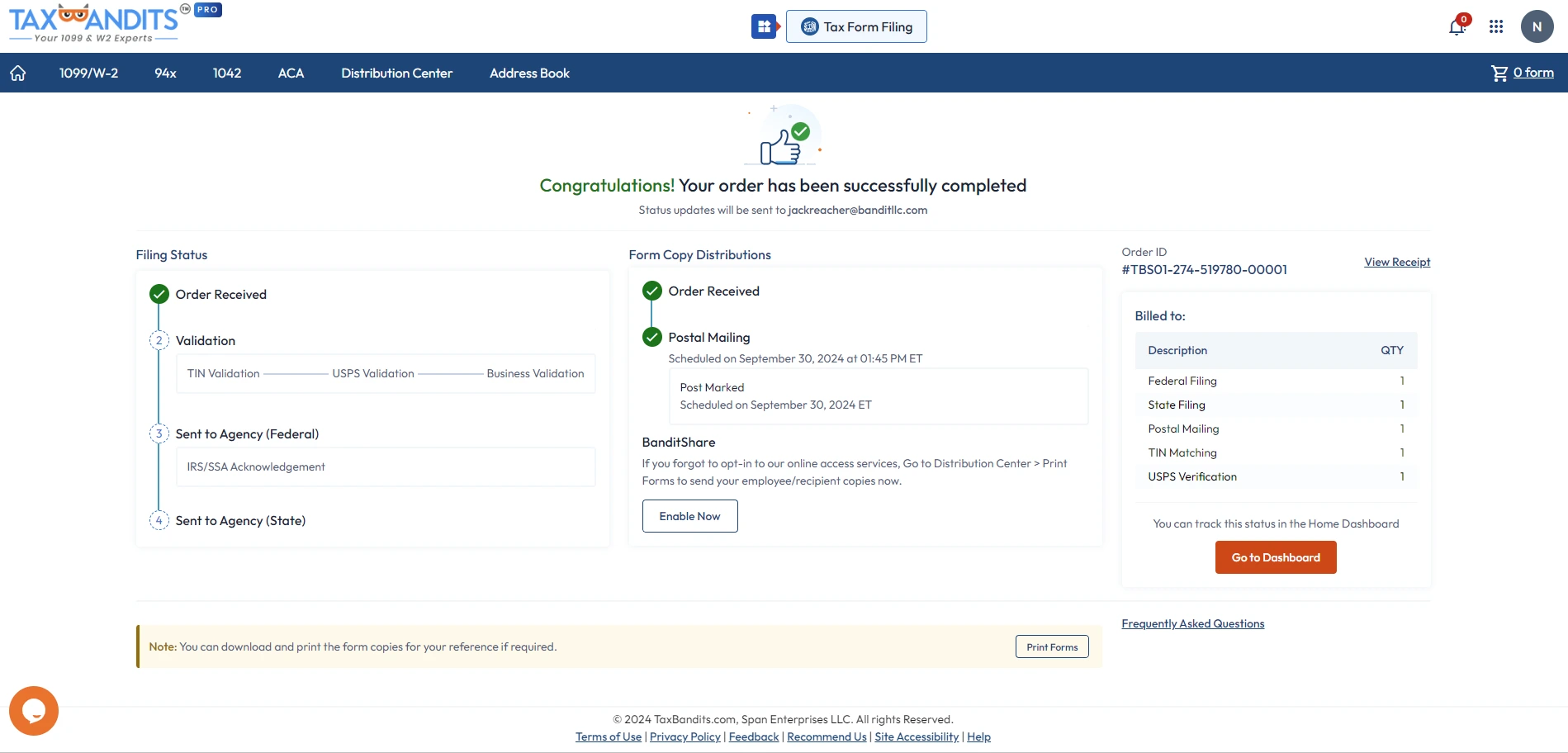

Step 4: Choose Distribution Options

Opt for our distribution services – Postal Mailing, Online Access, or BanditComplete.

-

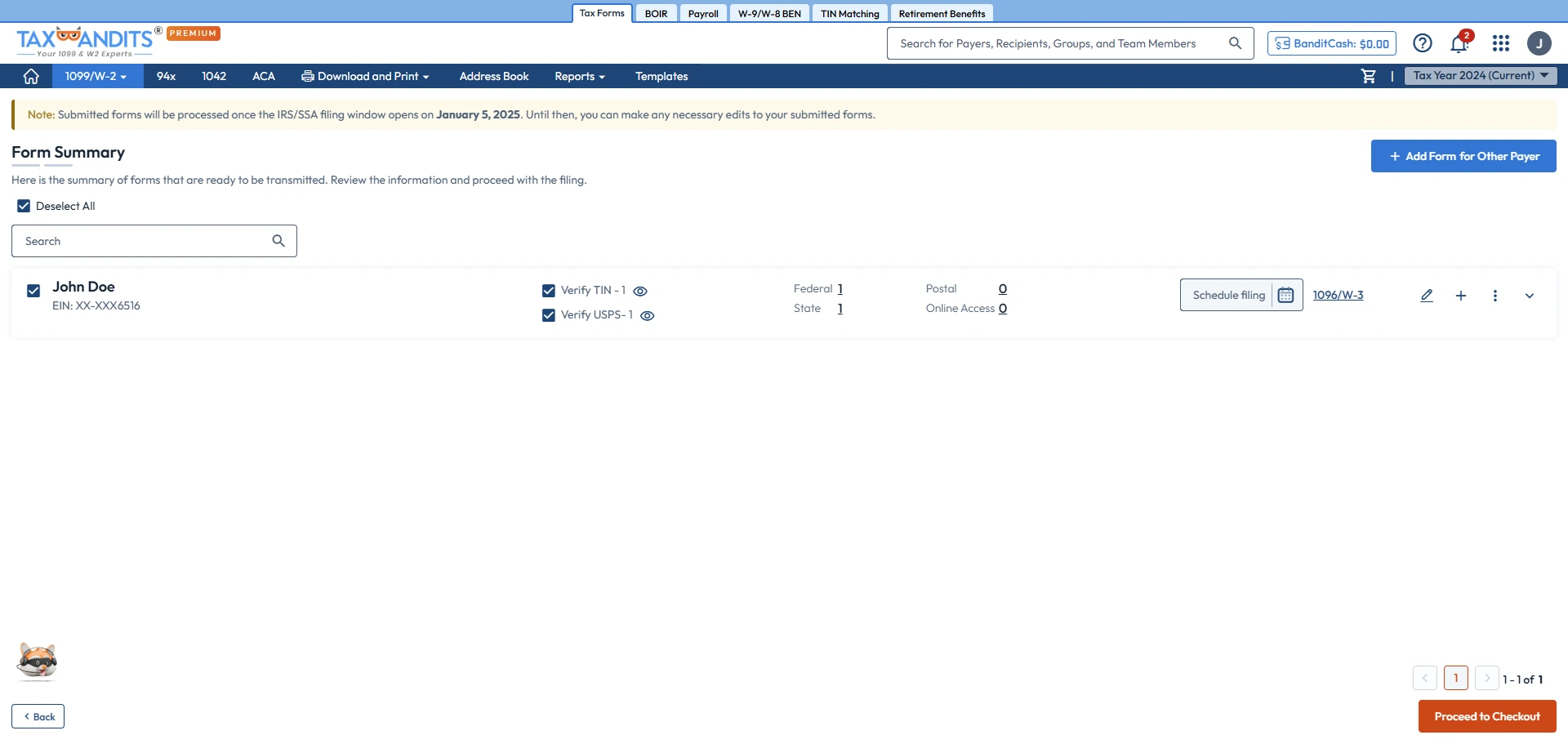

Step 5: Review and Transmit

Review your form and transmit it to the IRS and state agencies.

Start e-filing W-2 Forms with Alabama today—TaxBandits makes it quick and easy!

Frequently Asked Questions

Does Alabama require W-2 filing?

Yes, the Alabama Department of Revenue requires W-2 forms to be filed, even if no state tax is withheld.

Does Alabama have any additional requirements when you file W-2 forms?

Yes, Alabama requires additional forms to be filed along with Form W-2. Specifically, Form A-3 (Reconciliation) must be submitted if state tax is withheld.

What is Form A-3?

Form A-3 is an Annual Reconciliation used to report the total income taxes withheld from employees and taxes remitted to the state. Also, it is used to claim an overpayment refund or pay if the taxes are underpaid.

What is the deadline to file W-2 forms with Alabama?

The filing deadline for Alabama for Forms W-2 and A-3 is January 31st.

If this deadline falls on a weekend or federal holiday, the next business day is the deadline.

What are Alabama’s rules for electronic filing of W-2 forms?

The State of Alabama requires electronic filing if you are submitting 25 or more W-2s. Additionally, if you’ve paid taxes electronically during the year, W-2s must also be filed electronically.

What are the penalties for not filing or filing W-2 late with Alabama?

A penalty of $50 will be imposed for each Form W-2 not filed on time with the state of Alabama. Learn more about Form W-2 penalties.

Where should Alabama W-2s be mailed?

Mail Forms W-2 and A-3 to the following address:

Alabama Department of Revenue,

Withholding Tax Section,

P.O. Box 327480,

Montgomery, AL 36132-7480.

Get started with TaxBandits today and stay compliant with the State of Alabama! Start Filing Now

Can I file the correction form W-2c with the State of Alabama?

Yes, you can file W-2c with Alabama to clarify any errors.

Mail Forms W-2c to the following address:

Alabama Department of Revenue,

Withholding Tax Section,

P.O. Box 327480,

Montgomery, AL 36132-7480.

Success Starts with TaxBandits

The Smart Business Owners Choice

Alabama State Filing

How to File W-2 Forms with TaxBandits

Select Form W-2

Start by selecting Form W-2 from your dashboard. With TaxBandits, you can file this form for both the current and previous tax years.

Required information

Fill out the required W-2 information and the respective state information in the appropriate fields.

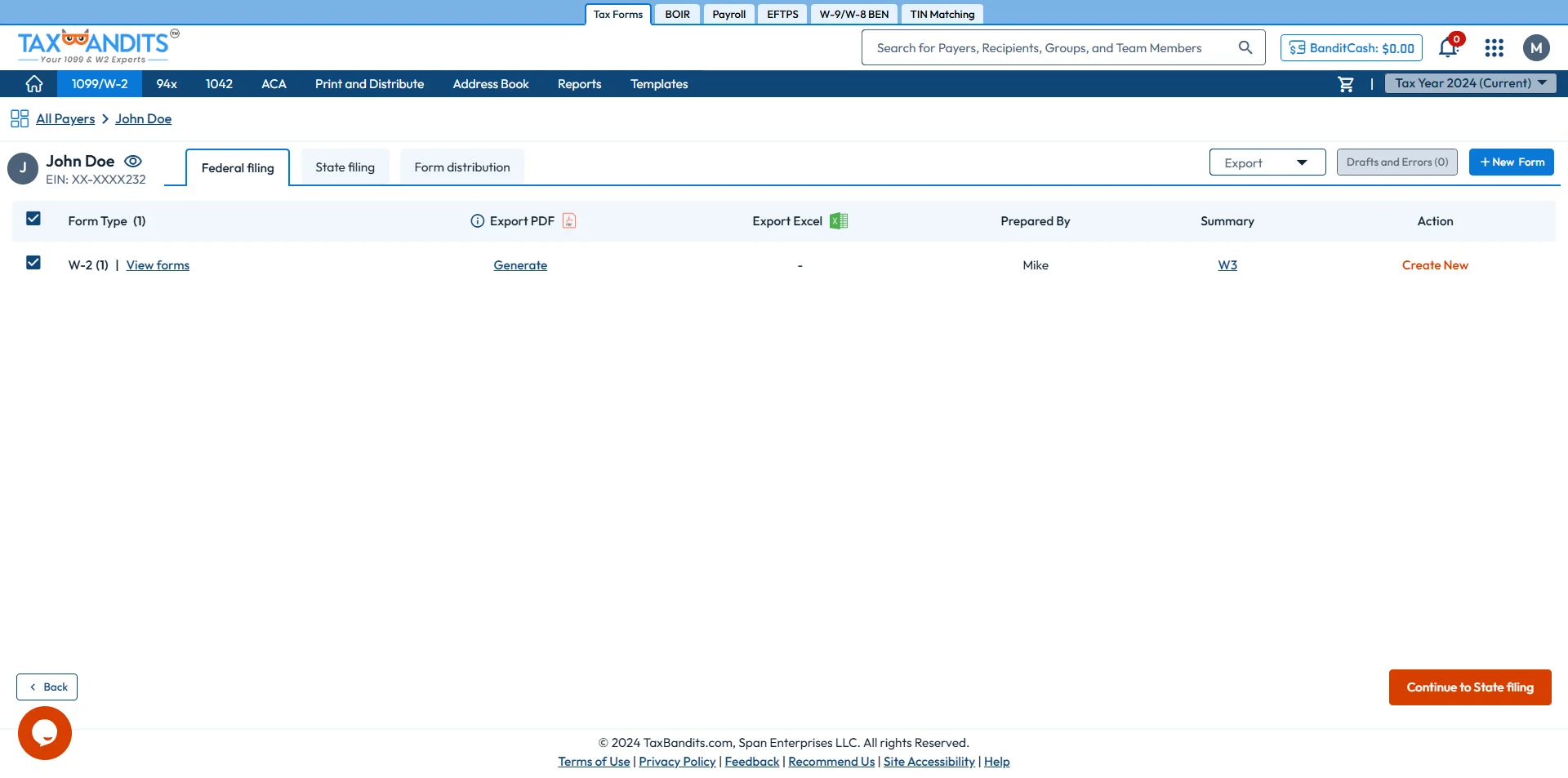

Review Federal Information

Review your Federal filing information and click "Continue to State Filing" to proceed further.

Select Reconciliation Form A-3

Click "Complete Form A-3" to complete your reconciliation form filing process.

Complete Form A-3 Information

Enter the required information in the respective fields and click “Save and Continue” to proceed.

Choose Distribution Options

Select how you'd like to distribute recipient copies: via mail, online access, or with the BanditComplete option.

Review Form W-2 Information

Review the information and make any necessary changes if needed.

Transmit the Form to the IRS/State

After reviewing, transmit the completed Form W-2 to the IRS and state.