Form W-2 Late Filing Penalty for 2024

Updated on October 23, 2024 - 10:30am by, TaxBandits

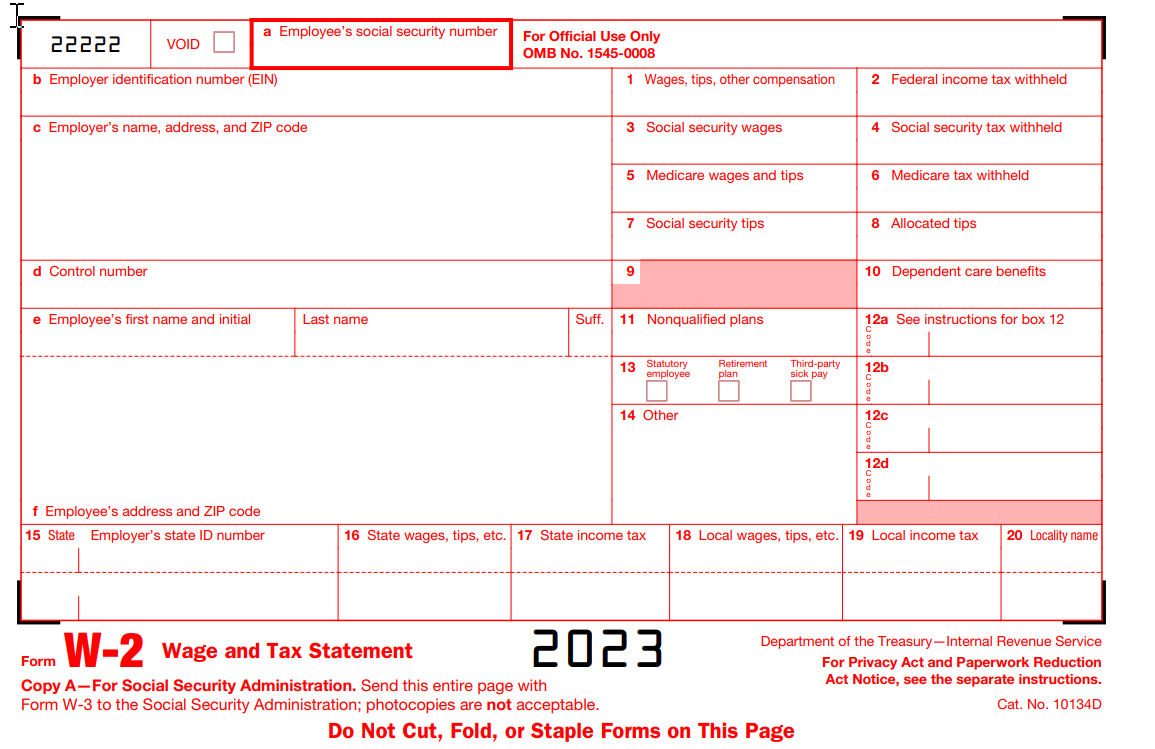

IRS Form W-2 is an annual payroll form that reports the taxes withheld from the employee's paycheck for the particular tax year. The employer uses it to file both federal and state taxes.

As the deadline for Form W-2 draws to a close, all employers need to file employees' W-2s along with W-3, the transmittal form, to the Security Security Administration (SSA) before the deadline.

Here, we cover the following topics:

1. When is the deadline for W2 Forms?

Employers must file Form W-2 with the SSA by January 31, 2025 for the following tax year 2024. Employers must also distribute a copy of Form W-2 to each employee before January 31, 2025.

Note: If the deadline falls on a weekend or federal holiday, the next weekday is the deadline.

2. Why is the Employer Fined for Filing W2 Late?

There are a number of reasons why an employer can be fined for not sending W-2 Form to the SSA.

Late Filing

|

Filing with incorrect information

|

Failing to give the required information

|

Wrong filing method

|

Failing to provide employee copies |

Fraudulent filing |

3. What is the Penalty for Employer not sending W2?

If you are an employer, the IRS will impose late filing penalties for Form W-2, which ranges between $60 and $330, depending on the delay period and your business size. The penalties have been increased for the 2024 tax year.

The IRS determines the late filing penalties for Form W2 based on the delay period and size of the business. Here is the overall breakdown of penalties for the 2024 tax year:

| Time limit | Minimum | Maximum |

|---|---|---|

| Filed within 30 days | $60 /form | $664,500 per year ($232,500 for small businesses) |

| After 30 days and before August 1 | $130 /form | $1,993,500 per year ($664,500 for small businesses) |

| After August 1 | $330 /form | $3,987,000 per year ($1,329,000 for small businesses) |

| For intentional disregard of failing to file and incorrect payee statements - $660 per statement | ||

| For fraudulent filing - $5000 or more | ||

Your business is classified as a small business if its average annual gross receipts for the three most recent tax years are $5 million or less.

E-file Form W-2 with TaxBandits before the deadline to stay away from the W-2 penalties. Get Started Now!

E-filing starting at $0.80/form. File now and use our postal mailing options to send the W-2 copies to

your employees.

4. What are the Penalties for not Filing W-2 with the State?

Some states require you to file Form W-2. Failing to file with the State may result in IRS penalties. These state penalties are to be paid in addition to the Federal penalties. The penalty rates differ for each state, depending on when you file

your return.

Check out the latest penalties and state filing requirements of the respective states.

5. How to avoid Form W-2 penalties?

Here are simple ways to avoid penalties.

- Do your tax filing on time

- Provide all necessary information

- Be aware of the right filing method

- Choose the right Form

- Fill the entries correctly

- Always double-check the TIN

- Review the form before Pay & Transmit

- Send employee copies on time.

Get Started Now with TaxBandits, an authorized efile provider that supports the filing of Form W-2. You can

E-file W-2 in minutes and postal mail copies to the employees.

With TaxBandits,

- You can file Form W2 Online with the SSA and the state.

- You can file W2s for both the current and prior tax years.

- Validate your employees’ TIN against the SSA Database.

- Send your employee copies on time by postal mail or through a secure online portal.

Related Blog for Form W-2