Mississippi Form W-2 & 89-140 Filing Requirements for 2024

Meet your Mississippi W-2 filing requirements confidently with TaxBandits—enjoy free corrections and retransmissions.

Simplify your Mississippi W-2 filing

with TaxBandits

- Easily prepare and e-file your W-2 form

- Deliver employee copies by Mail or Online

-

Lowest pricing in the industry - E-file at

just $0.70/form

-

Default State

- Filing Criteria

- Information Required

- How to File

- FAQs

Mississippi W-2 Filing Criteria for 2024

The State of Mississippi mandates W-2 filing regardless of state tax withheld.

| Filing Criteria | Form W-2 |

|---|---|

|

Criteria 1 If there is Mississippi state tax withheld |

Filing Method: Direct State Filing Additional Form: Form 89-140 Deadline: January 31, 2025 Pricing: W-2 State Filing - $0.70/form |

|

Criteria 1 If there is no Mississippi State Tax Withholding |

Filing Method: Direct State Filing Additional Form: Not Required Deadline: January 31, 2025 Pricing: W-2 State Filing - $0.70/form |

Ready to start filing W-2s with Mississippi?

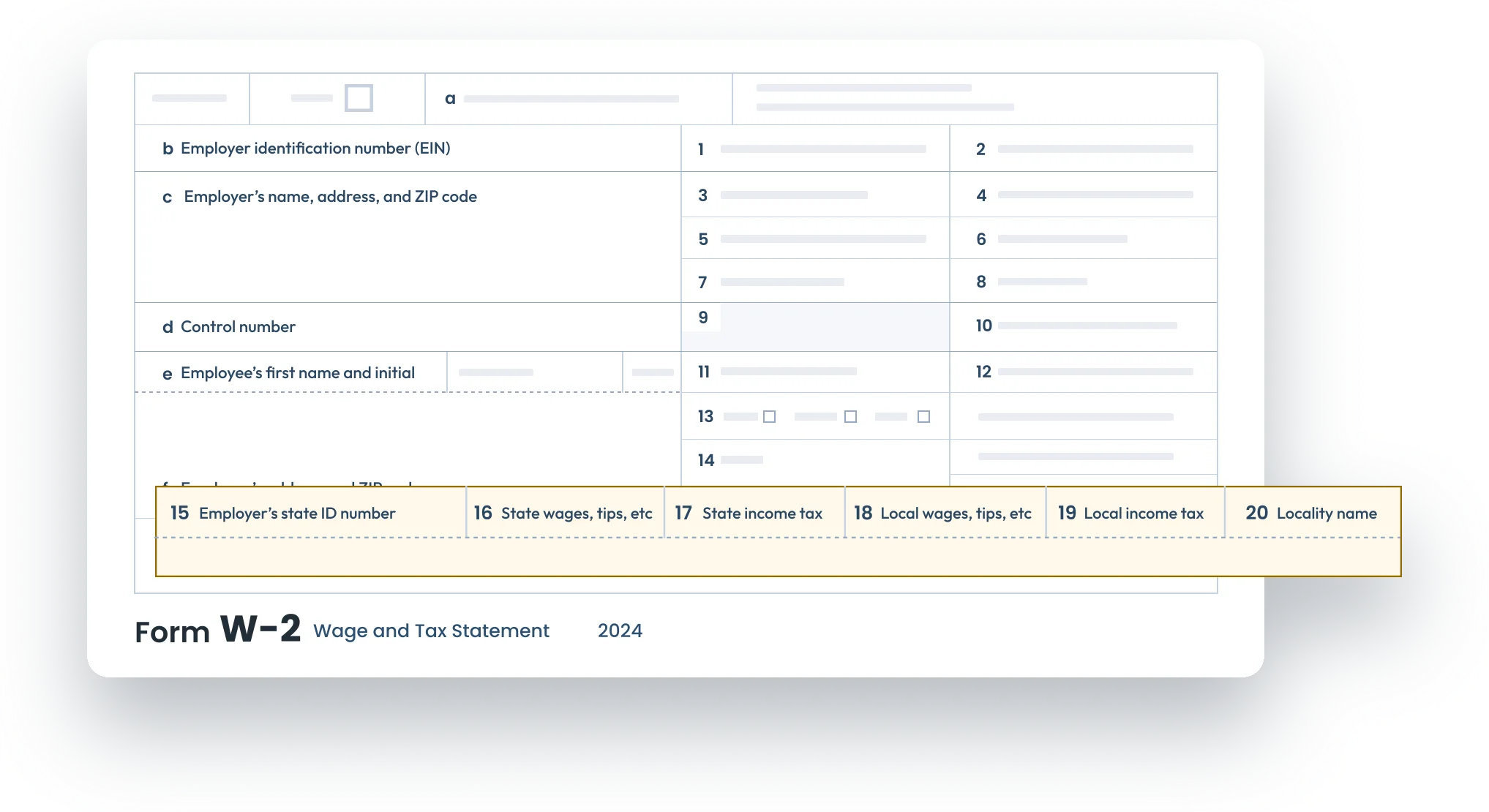

Information Required to File W-2 Forms with Mississippi

Discover the key information needed to file Form W2 with the State of Mississippi.

1. Employer’s state ID number

The employer's state identification number refers to the Mississippi Withholding Tax Account Number.

Mississippi State ID Format:

- 8 digits starting with 4 digits and a hyphen followed by 4 digits (Eg: 9999-9999)

- 9 digits starting with 2 digit hyphen followed by 7 digits (Eg: 99-9999999)

- 9 digits (Eg: 999999999)

2. Mississippi state/local wages

The total amount of taxable wages, tips, that is subject to Mississippi state income tax.

3. Mississippi state/local tax withheld

The total amount of state income taxes withheld from the employee’s wages.

If you’ve withheld any Mississippi taxes, you must file Reconciliation Form 89-140.

E-file Form W-2 with Mississippi state in minutes using TaxBandits!

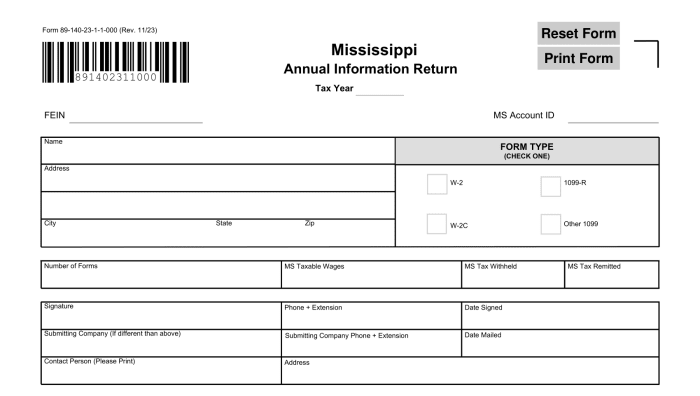

Mississippi Annual Reconciliation Form 89-140

Form 89-140 is an Annual Reconciliation used by employers to report and reconcile state income tax withheld from employees' wages throughout the year. It ensures compliance with Mississippi's tax withholding requirements and is filed annually.

The following information needs to be reported on Form 89-140:

- Total number of Forms

- Mississippi(MS) taxable wages

- Mississippi(MS) tax withheld

- Mississippi(MS) tax remitted

E-file W-2 with with Mississippi state in minutes using TaxBandits!

TaxBandits – Simplifying Mississippi State W-2 Compliance

TaxBandits supports the e-filing of W-2 forms directly with the Mississippi Department of Revenue, ensuring compliance with state regulations.

Lowest Pricing

Lowest Pricing

TaxBandits offers the most affordable solution for Mississippi W-2 filings, saving you both time and money.

State Filing Guidance

State Filing Guidance

Our detailed instructions at every step assist you in completing your W-2 e-filing effortlessly and correctly, minimizing mistakes.

Free W-2 State Corrections

Free W-2 State Corrections

TaxBandits supports e-filing of W-2 corrections with the State of Mississippi at no additional cost if the original form was filed with us.

Free Resubmissions

Free Resubmissions

If your W-2 forms are rejected by the Mississippi Department of Revenue, you can correct errors and resubmit them for free.

Start filing your Mississippi W-2 returns with TaxBandits by creating an account!

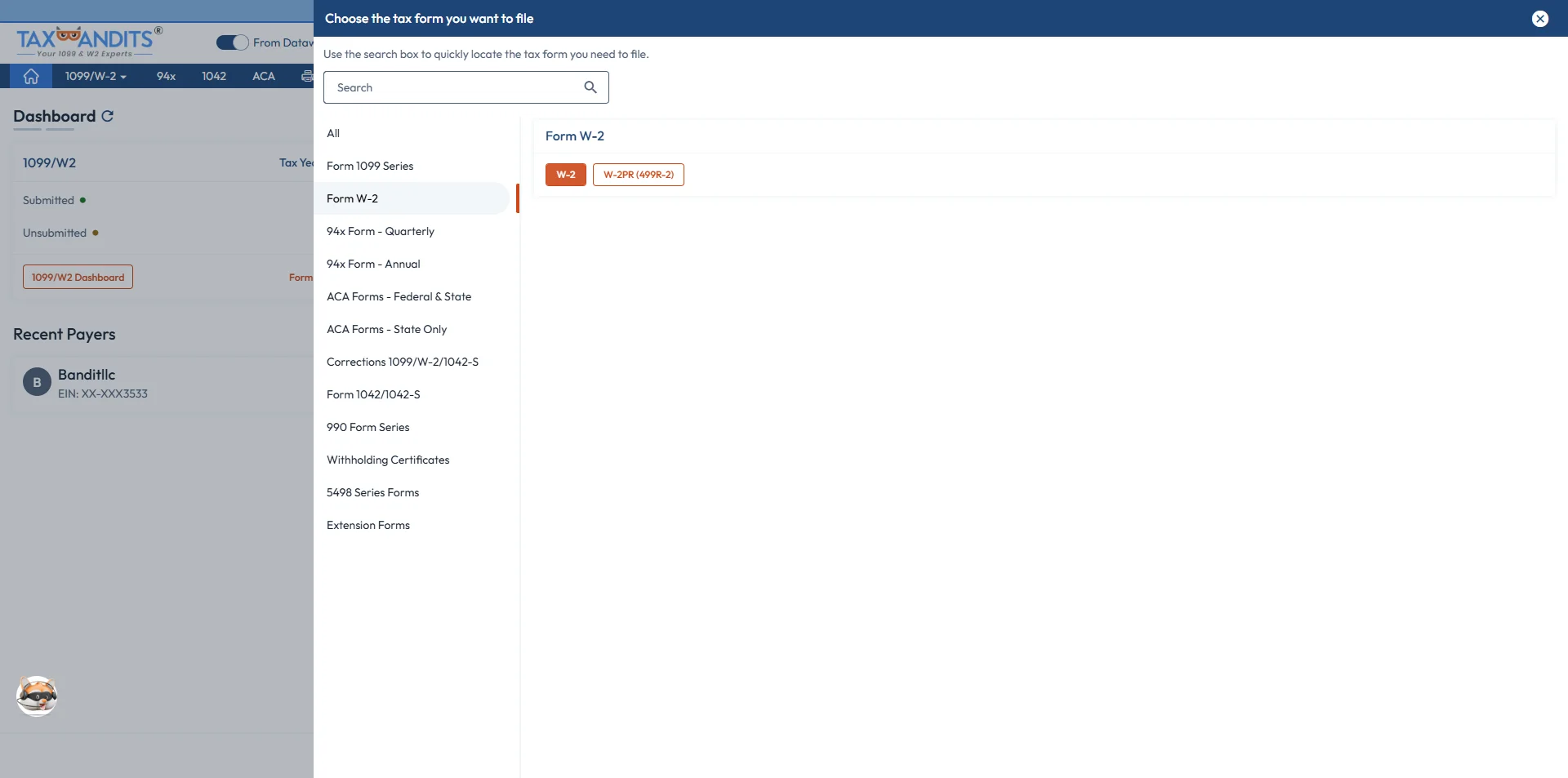

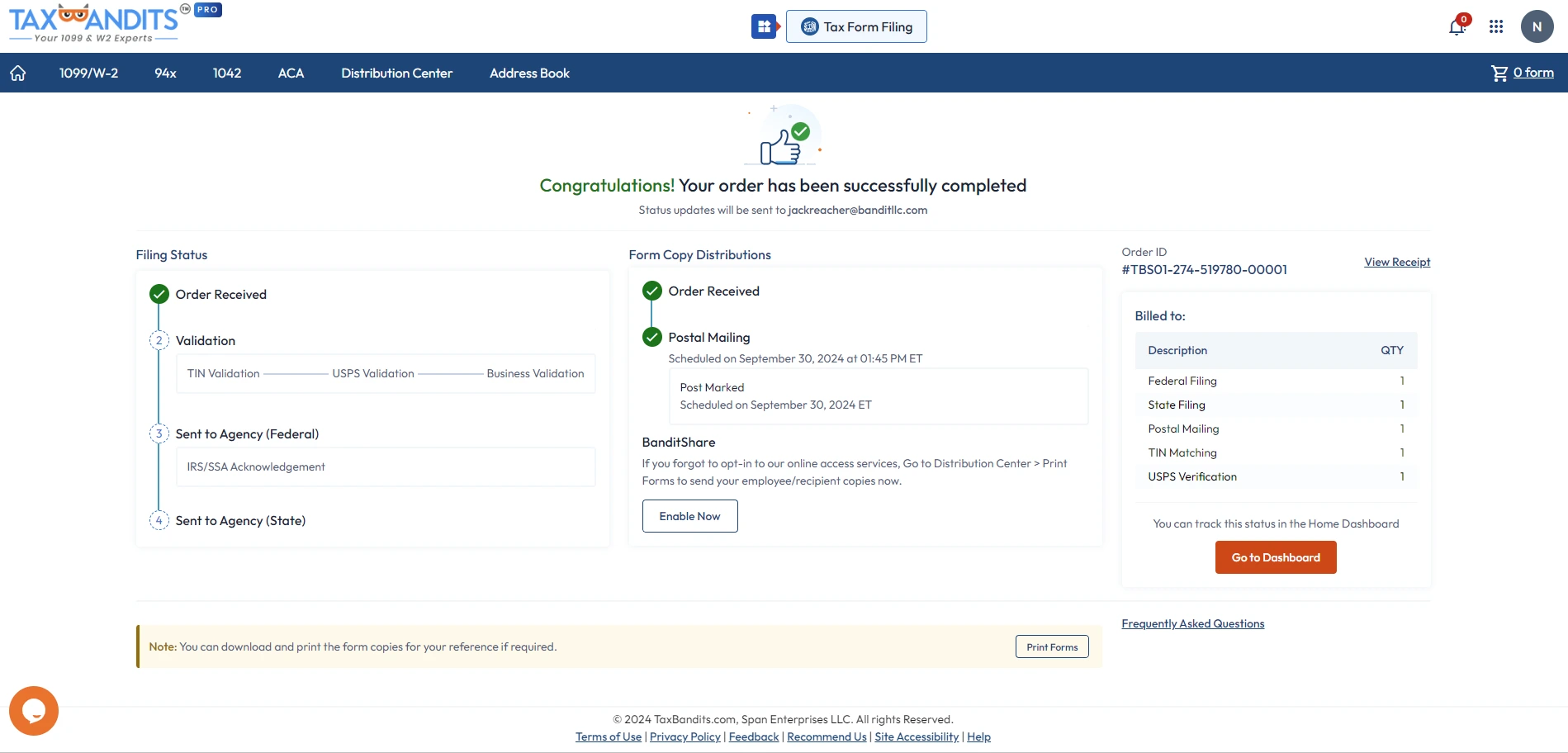

How Is Form W-2 Filed with the State of Mississippi?

Create your account and follow these steps to easily e-file your W-2s with the SSA and State of Mississippi!

-

Step 1: Choose Form W-2

Select the type of W-2 form you want to file.

-

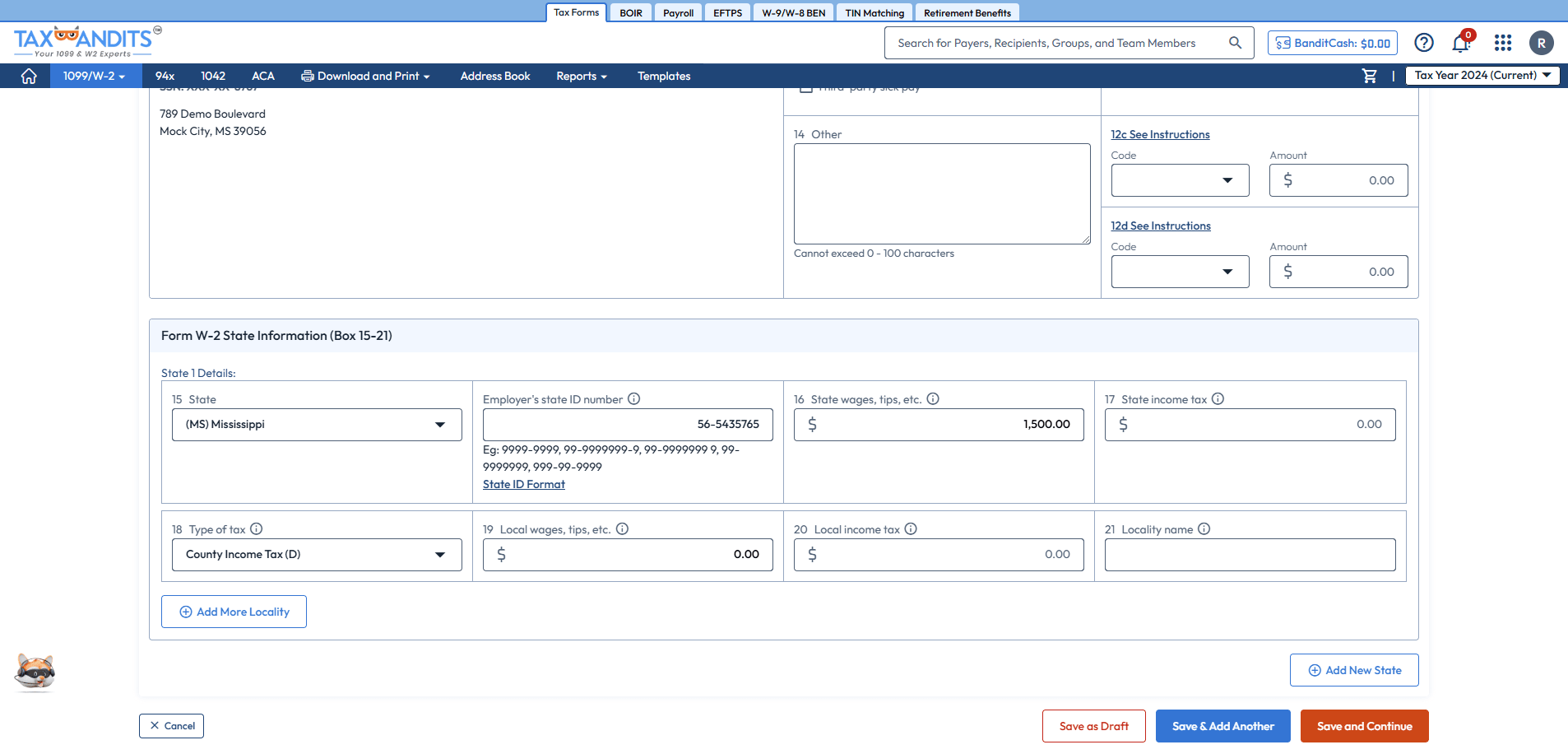

Step 2: Enter Form W-2 details

Complete the form using manual entry or other bulk import options.

-

Step 3: Enter State Filing Information

Provide the required Mississippi state details for Form W-2.

-

Step 4: Choose Distribution Options

Opt for our distribution services – Postal Mailing, Online Access, or BanditComplete.

-

Step 5: Review and Transmit

Review your form and transmit it to the IRS and state agencies.

Start e-filing W-2 Forms with Mississippi today—TaxBandits makes it quick and easy!

Frequently Asked Questions

Does Mississippi require W2 filing?

Yes! The state of Mississippi mandates the filing of Form W-2 only if there is state withholding.

Does Mississippi require any additional forms to be submitted while filing W-2?

Yes! When you file W-2 with Mississippi, you must attach additional forms based on the mode of filing.

If you e-file, you don’t have to submit any additional forms with W-2. Here at TaxBandits, we support the e-filing of W-2 with Mississippi.

If you choose to paper file W-2, you must include W-3 & Form 89-140.

What is the deadline to file W-2 with Mississippi?

For the tax year 2024, the deadline to file Form W-2 is January 31.

If the deadline falls on a weekend or federal holiday, the next weekday is the deadline.

Can I electronically file W-2 with Mississippi?

Yes, you can electronically file W-2 with Mississippi. It is mandatory to e-file with the state if you want to file 25 or more W-2s.

If you are looking for a certified e-file service provider, TaxBandits is here! We support both Federal and State filing of W-2s.

What are the W-2 penalties for Mississippi?

The state of Mississippi imposes W-2 penalties and interests for the following:

| W-2 | Penalties & Interests |

|---|---|

|

Late filing or not filing at all |

$5/return with a minimum of $250 and a maximum of $10,000 |

|

Paying the taxes late |

The penalty is 10% of your unpaid taxes. Interest is 1% of your unpaid taxes per month, and it will be calculated from the time it is due until you pay it. |

|

Not furnishing form copies to employees |

$5/return with a minimum of $250 and a maximum of $10,000 |

|

Intentional Disregard |

$25/return with a minimum of $250 and a maximum of $10,000 |

Learn more about Form W-2 penalties.

Can I file W-2c with the State of Mississippi?

Yes, you can submit W-2c with the State of Mississippi if you find errors on the previously filed W-2. If you choose to paper file, attach Form 89-140 with W-2c and send them to:

Department of Revenue

Withholding Tax Division

P.O. Box 23058

Jackson, MS 39225-3058

TaxBandits supports W-2c e-filing with the State of Mississippi. Create your FREE account now to start e-filing your W-2c forms.

Where do I mail W-2 forms when filing with the state of Mississippi?

You should only send the form copies when you paper file. The State accepts the paper filing of W-2 only you file 24 or fewer forms. If you file 25 W-2s or more, you must electronically file.

Whether you file 10 or 1000 forms, e-filing is more convenient, and the state will process your returns quickly. If you still prefer to paper file, attach W-3 & Form 89-140 and send form copies to the address below:

Department of Revenue

Withholding Tax Division

P.O. Box 23058

Jackson, MS 39225-3058

If you’re looking for an IRS-certified e-file provider, check out TaxBandits! We support the e-filing of W-2 with the SSA and states.

For more information, please visit the State website: https://www.dor.ms.gov/.

Success Starts with TaxBandits

An IRS Authorized E-file provider you can trust

How to File W-2 Forms with TaxBandits

Select Form W-2

Start by selecting Form W-2 from your dashboard. With TaxBandits, you can file this form for both the current and previous tax years.

Required information

Fill out the required W-2 information and the respective state information in the appropriate fields.

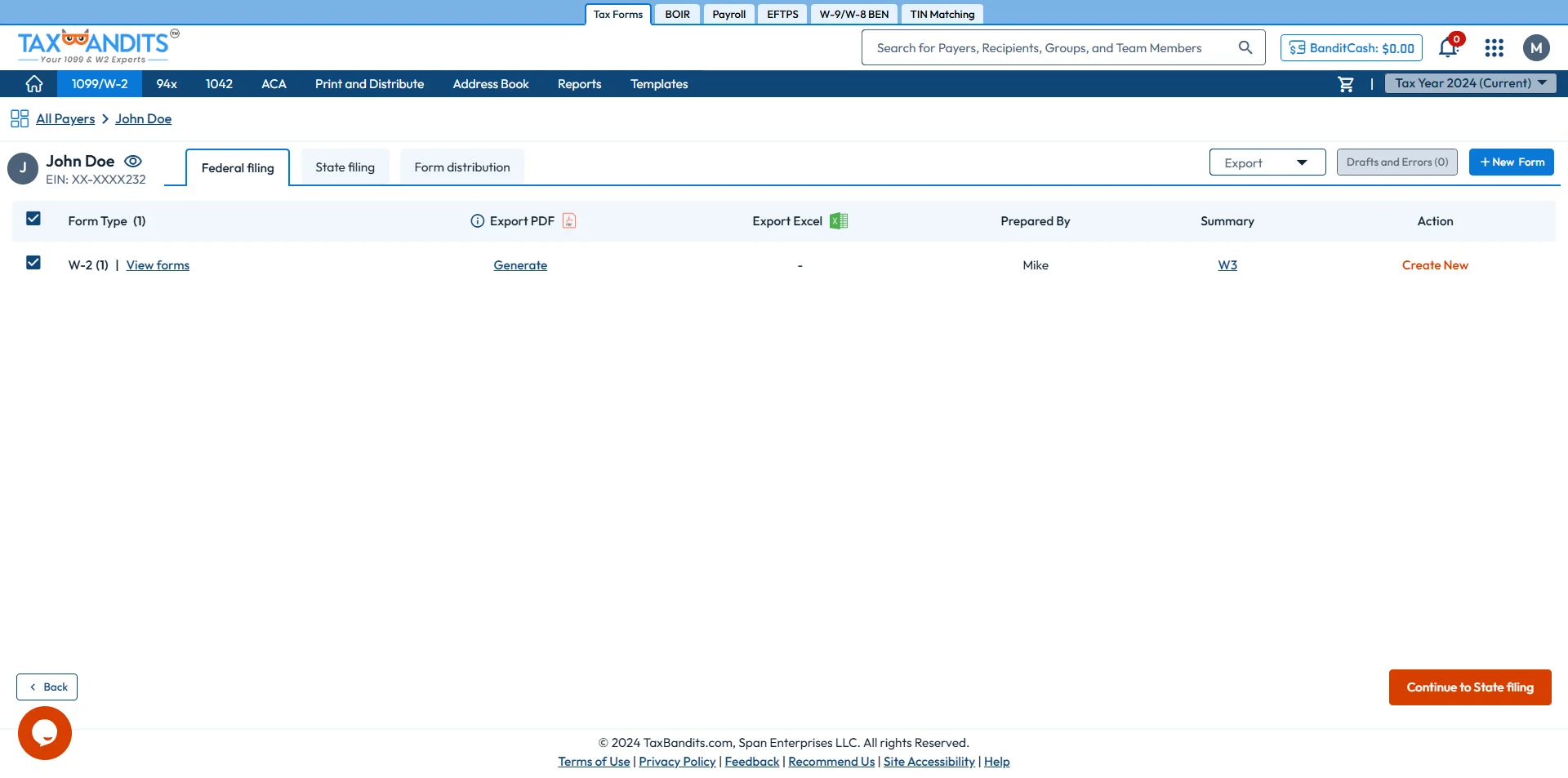

Review Federal Information

Review your Federal filing information and click "Continue to State Filing" to proceed further.

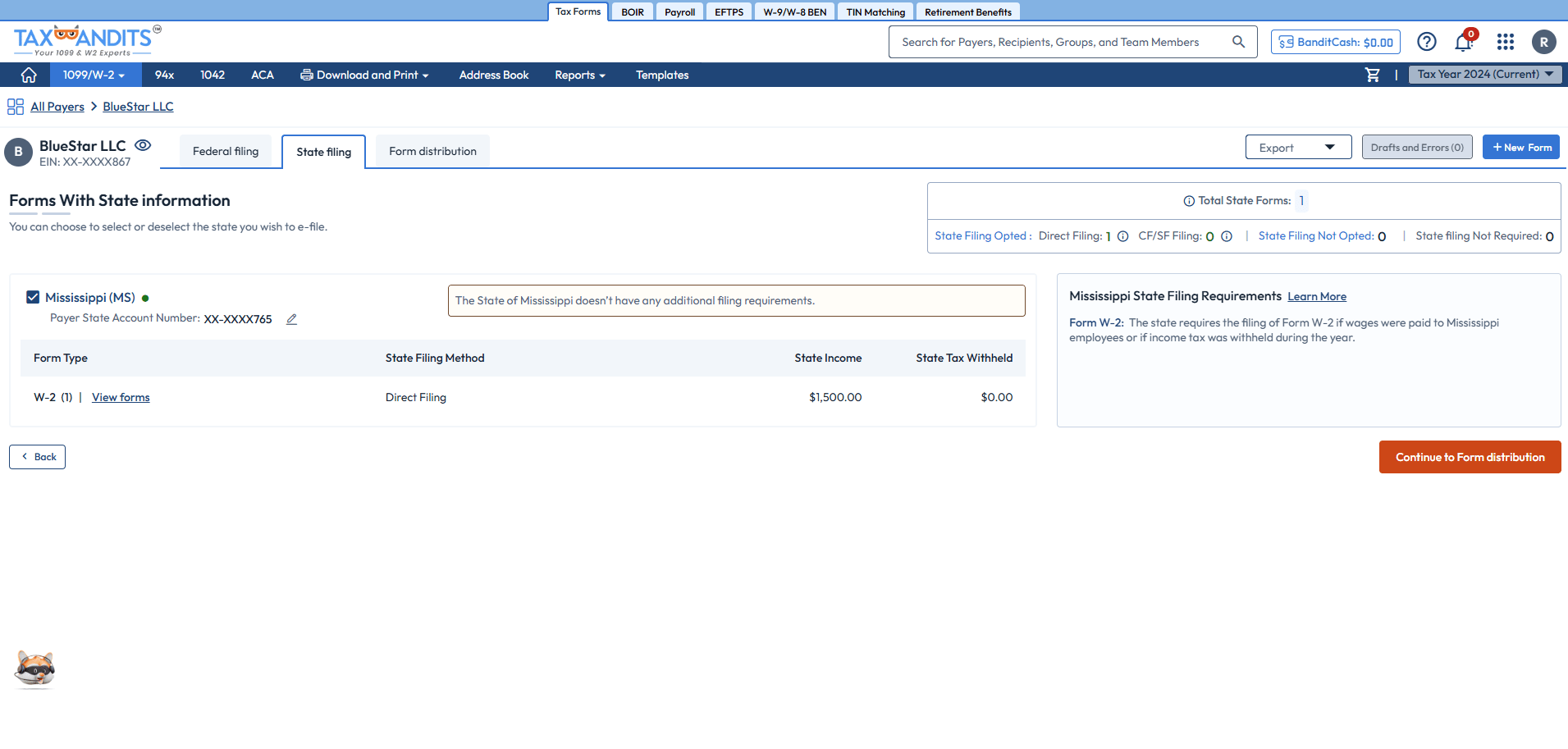

Review State Filing Information

Review your state filing information and click "Continue to form disturibution" to proceed further.

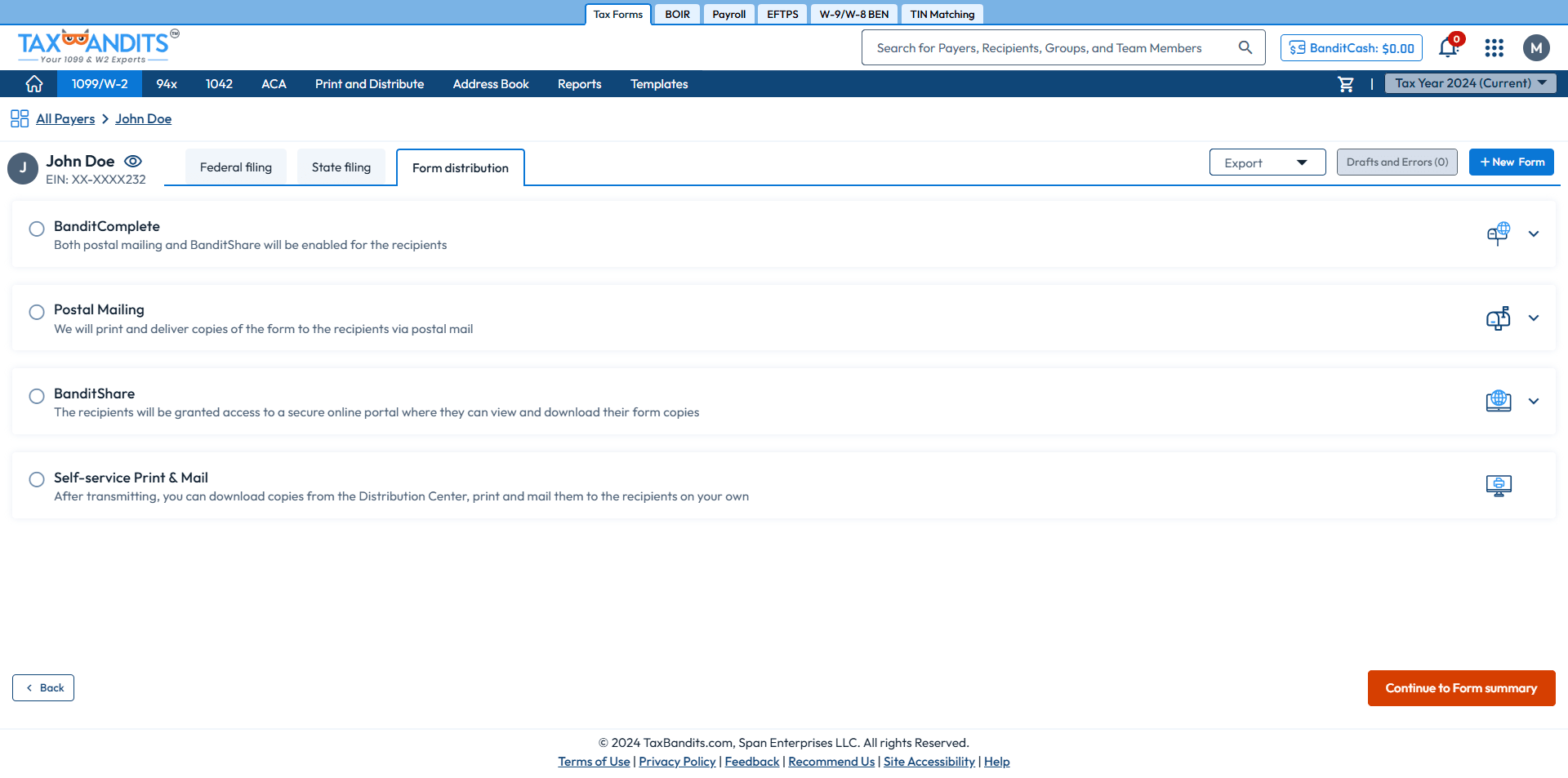

Choose Distribution Options

Select how you'd like to distribute recipient copies: via mail, online access, or with the BanditComplete option.

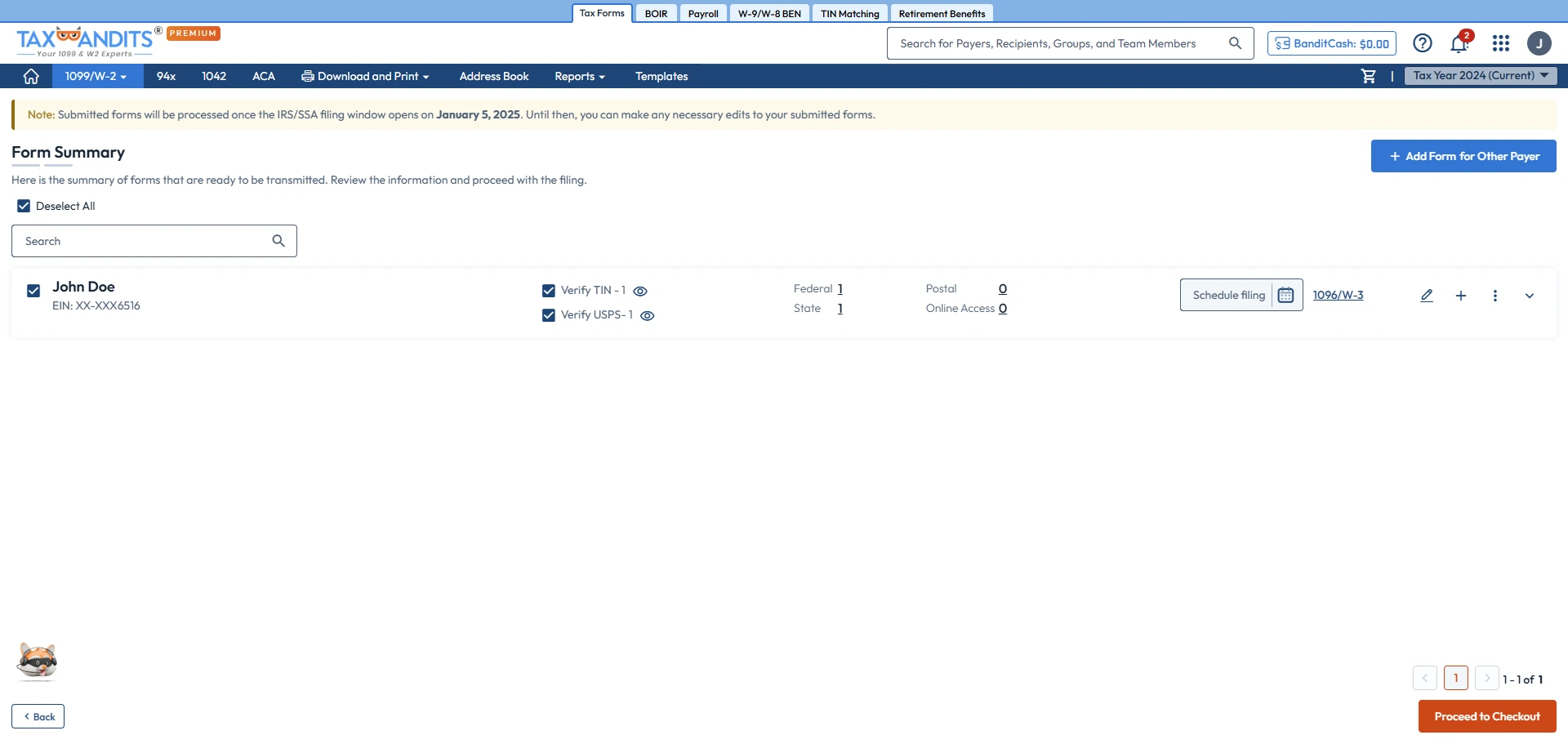

Review Form W-2 Information

Review the information and make any necessary changes if needed.

Transmit the Form to the IRS/State

After reviewing, transmit the completed Form W-2 to the IRS and state.